Have you heard this saying? Time in the market refers to the concept of consistently investing in the stock market or real estate market over a long period of time, rather than trying to predict short-term movements and making trades based on those predictions. Timing the market, on the other hand, involves trying to predict when prices will go up or down in the short term and making trades accordingly.

Time IN the market only works if you select an investment that will be relevant over the long term. This is why we love real estate – people will always need land and a roof over their heads. This is the main reason property continues to appreciate long term – there is always a level of demand. You can’t just pick any property, though. Be diligent about selecting something that will stand the test of time, both location & build-wise.

Choosing the right property:

- Location and Accessibility: Choose a property in a well-established and desirable location with convenient access to essential amenities, public transportation, schools, and commercial centers. A prime location maintains its value over time and attracts a steady demand from potential buyers or renters.

- Build Quality and Materials: Prioritize properties constructed with high-quality materials and craftsmanship. Well-built structures not only endure the effects of time but also require fewer maintenance expenses in the long run, preserving their appeal and value.

- Future Development and Infrastructure: Research the area’s development plans and infrastructure projects. A property that is poised to benefit from future improvements, such as new roads, parks, or community facilities, is more likely to appreciate value and remain relevant over time.

- Adaptability and Flexibility: Look for properties with versatile layouts and features that can accommodate changing lifestyle trends. A space that can be easily modified or repurposed to suit evolving needs ensures its long-term relevance and appeal to a broad range of potential occupants.

- Resilience to Environmental Factors: Consider the property’s vulnerability to natural disasters and environmental changes. Opt for structures that are designed to withstand local climate conditions, such as earthquakes, floods, or extreme weather. Investing in a property that can endure environmental challenges minimizes the risk of significant damage and devaluation.

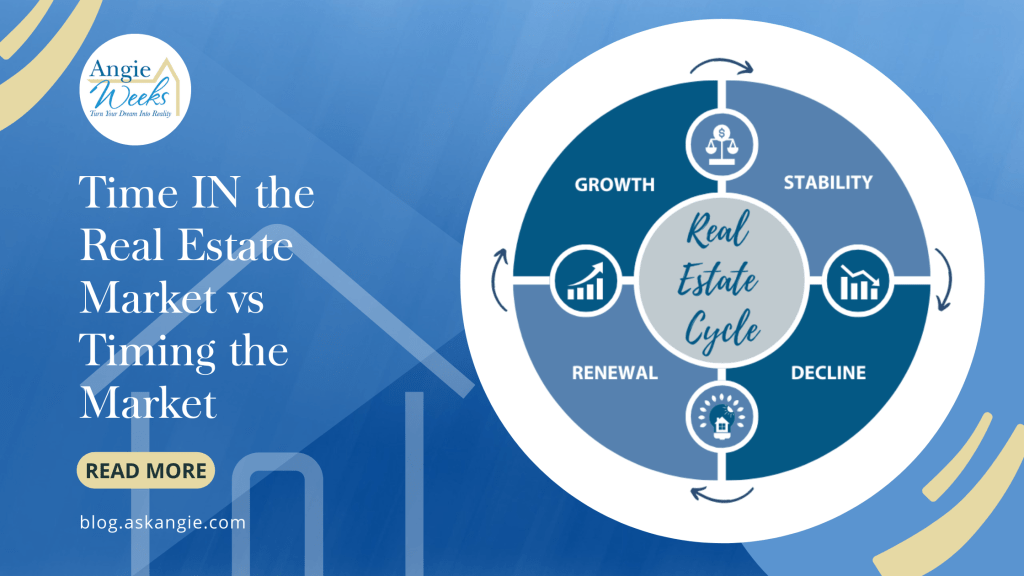

Know what to expect with property cycles

According to information available on the California State Board of Equalization website, every neighborhood & city has 4 cycles – it’s good to be familiar with them, so you can ride out any bumps on the road:

- Growth: a period during which the area gains in public favor or acceptance.

- Stability: a period of equilibrium without significant gains or losses.

- Decline: a period of diminishing demand and acceptance.

- Renewal: a period of rejuvenation and rebirth of market demand.

Tracking your real estate investments

It’s also critically important to know where your property is at price-wise and watch the numbers just like you would watch your stock portfolio or money market account. Your property value will always fluctuate. We offer informational free reports emailed monthly & recommend you sign up today if you aren’t already receiving similar reports. Our value system takes a comprehensive view of any single-family home in the US – sign up here https://hmbt.co/TTNcDG.

It’s also important to note that trying to time the market is generally considered to be a risky strategy, as it’s extremely difficult to consistently predict short-term market movements. In contrast, time in the market has been shown to be a more reliable way to achieve long-term investment success, as it allows you to take advantage of the natural ups and downs of the market over time.

Grandma appreciation scenarios can be helpful to consider when thinking about the long-term benefits of owning a home. For example, let’s say you buy a home for $500,000 and the market appreciates at a rate of 5% per year. After 20 years, the value of your home would be about $1.1 million. If you had instead rented for those 20 years and paid an average of $3,500 per month, you would have spent around $840,000 on rent, and you would have nothing to show for it at the end.

In the current market, rates are rising and prices are still high, which can make it a challenging time for first-time homebuyers. However, it’s important to remember that owning a home or land for 20-40 years can have a significant impact on your financial future and retirement. In fact, homeownership has been shown to be a key factor in building wealth over the long term, as homes tend to appreciate in value over time.

If you’re considering buying your first home but are worried about the cost, it may be helpful to work with a financial advisor or mortgage professional to explore your options. Derek Beisner, Certified Mortgage Planner, can help with a rent vs own analysis that will give you some research and can provide you with more information about the benefits of homeownership. If you don’t have the down payment, you may want to consider the Vow2Save program, which can help you save for a down payment on your first home or investment property.

Ultimately, it’s never a bad time to buy your first home, as long as you do your research, work with a professional, and carefully consider your financial situation and long-term goals. If you’re ready to take the next step, don’t hesitate to reach out to Angie for a no-obligation consultation about buying your first home or investment property at 949-338-7408.

Share your real estate success stories

We’d love to hear your stories and insights about how time has shaped your experiences IN the market. Share your anecdotes, observations, and lessons learned in the comments below. Your point of view could offer valuable understanding to individuals navigating the realm of real estate!

Leave a comment