This week we had the unfortunate task of stopping a foreclosure sale. Long story short, the buyer’s wire didn’t get to escrow in time for escrow to move the funds to title, & title to pay off the existing loan. This put our divorcing sellers in a terrible hands-tied position and at risk of losing the 150k+ in equity they still had in their home. We had to basically drop everything & work all day & night long to save this property from being sold at auction.

I want to share how things unraveled and how we stopped the foreclosure sale, in case other Realtors or homeowners need tips on how to stop their own foreclosure or auction sale.

It Takes a Team to Fight Foreclosure

First off, I want to point out this is never a one person job. At least TWENTY people were involved & acting fast (or slow) to help pull this off. I will be giving credit where credit is due as you read on. There were at least 10 people CC’d on every email. Outside consultants who had nothing to do with this deal were called. LinkedIn connections & messages were sent. Social media posts were fired off.

It all started with an incorrect payoff demand that had Friday’s date instead of Monday or Tuesday. The property auction was scheduled for Tuesday 8/7 at 1pm. The bank HAD to be paid off before that time. Escrow brought this to my attention the previous week, stating the attorneys who were acting as the trustees for Flagstar Mortgage were not getting them the updated payoff demand. For the record, the buyer was SUPPOSED to bring his funds to escrow on Friday, but he was ‘too busy’. Gee, thanks. Attorneys moving slow, cash investors moving slow…us prodding cattle.

It all started with an incorrect payoff demand that had Friday’s date instead of Monday or Tuesday. The property auction was scheduled for Tuesday 8/7 at 1pm. The bank HAD to be paid off before that time. Escrow brought this to my attention the previous week, stating the attorneys who were acting as the trustees for Flagstar Mortgage were not getting them the updated payoff demand. For the record, the buyer was SUPPOSED to bring his funds to escrow on Friday, but he was ‘too busy’. Gee, thanks. Attorneys moving slow, cash investors moving slow…us prodding cattle.

Come Monday, I was told at 9am by the buyers agent Clay Matthews of New Western Acquisitions that the wire had been sent. Great, we made it in the nick of time! We thought. Until escrow calls me at 11am stating they still don’t have the funds. I call Clay again, and he stated the funds have been wired, he will call B of A. Well, in his call he discovers the girl who sends out all the wires for B of A was supposedly on vacation, so the wire did not get to escrow until 1pm.

Foreclosure Sales are ALWAYS messy

This still should have been ok, but enter in technicalities, wire cutoff times, & paranoid high ups at Corinthian Title. Although escrow got the wire to title, title refused to ‘pay off’ the loan because Flagstar Mortgage would not receive the funds until Tuesday morning, and their ‘payoff demand’ expired Friday. They had an ok from Flagstar to press the payoff until 5pm on Monday, but not a moment afterward.

So, we need an updated payoff demand then. But escrow had been asking the attorneys representing Flagstar at Zieve, Broadnax & Steele since last week, & they had not given it to us. Now when we call & email 3x on Monday we get a response….it was ‘too close’ to the sale date; they refused to give us the updated document, and said they needed permission from Flagstar. How. Convenient.

I called Flagstar, and in traditional foreclosure loophole fashion, they proceed to tell me that the attorneys at Zieve must stop the sale, they have no control anymore. I get the name & extension of the rep & proceed to call back Zieve, Broadnax & Steele, who never answer the phone and have a lovely one star review on Google. I go on their website & find out who the partners are, and I email their Foreclosure Attorney along with our rep. Katherine Walker emails me back a bunch of legal mumbo jumbo but states if I can get Flagstar to request a postponement, then she will postpone the sale. An inch of progress.

I know I’m out of time and this finger pointing / permission needing / document requirements will go all the way up to the foreclosure if I can’t cut through the BS and get to a decision maker. I start with my partners first.

Begging, Borrowing & Pleading to Stop a Foreclosure

I call Teresa at Corinthian Title and she advises me that there is no way to record title if a wire is still out, absolutely none. I say fine, just pay it off tomorrow very first thing, and she advises me no, that can’t be done either, because the demand expires today. I request that she simply pad the payoff with additional funds so even if more money is owed for this one day, we still get the proper payoff over, even if it’s too much. I plead my clients case to her and still get nowhere. I realize she is just doing her job…but SOMEONE over there should be able to help me, so I ask her to connect me with an individual who CAN authorize this.

She puts me in touch with Mike Godwin, CEO of Corinthian Title, who I plead with further. Mike explains he ‘cant insure’ the title when it is in this risky of a position, and he can only record it IF we get the payoff demand AND if we now get a sale date extension. (Basically perform a freaking miracle so he can CYA) I asked him what the real risk is here and I still don’t understand what it was. I reminded him my clients have 150k in equity in this house and the bank is drooling to take back this property…and he has the power to help them, or to devastate them right now. He still refuses to record the title. Eff. I have exclusively used Corinthian for ALL my title deals since our reps moved there & this is what we get for it??? Seriously!?!!! Shame on you, Mike Godwin.

I literally hang up with policy-pushing Mike & cry. But I have to keep moving on. This is SO unfair. I can’t leave it like this. Please know…..this is where MOST Realtors would have thrown up their hands. It’s 4:45pm & no chance of a title recording today anymore. The sale is mid day TOMORROW.

Fine. If my partners wont’ help then maybe I can network. I then reach out to a real estate attorney I know to see if he knows the attorneys at Zieve, because attorneys all seem to be in the same ‘bro’ club. No luck. I ask him what for SURE way we can stop the sale at 1pm tomorrow, & he advises my clients would have to declare bankruptcy. I can’t recommend THAT to them. They are already so beat down from their divorce. I call my client with an update and he reaches out to a well connected attorney HE knows. They also email and leave a message for Katherine Walker with no reply.

Delay Foreclosure with Social Media

Sigh……..the clock ticks on… so I guess it’s time to swallow my pride & go social. I had already tweeted Flagstar on my own a couple times with nothing yet.

I proceed to search Flagstar Mortgage on LinkedIn to find someone in loss mitigation. Sweet, they are in Michigan. I’m from there, so maybe these people will show some love. I send out connection requests and nice customized emails to all of them pleading my case. While doing that…LinkedIn pops up an alert that states ‘Your connection with the most connections to Flagstar is Desiree Patno’. I know her from Homeownership Day & NAWRB. She’s BEYOND busy. I decide not to bother her.

I humbly create an Insta message recruiting my friends to help. I ask them to send a specific tweet Flagstar. I know that banks HATE being pounded on Twitter. They care more about their reputation than they do your case, so I’ve gotta pelt that to get your case handled.

I humbly create an Insta message recruiting my friends to help. I ask them to send a specific tweet Flagstar. I know that banks HATE being pounded on Twitter. They care more about their reputation than they do your case, so I’ve gotta pelt that to get your case handled.

I smile through my tears as friends & other do-gooders tweet out my message. I ask the buyers agent Clay to help….crickets. Oh, but he did manage to give the keys to the property away & his clients started moving in. Before close. My clients asked me about it and I literally had to tell them that I cannot focus on who is moving into your house right now…I have to stop your foreclosure. How embarrassing….status = sh*tshow.

Engage National & Local Organizations to Postpone Foreclosure

It’s about midnight, and I still can’t sleep. I decide it’s my ego that is causing me not to contact Desiree, so I email her & her trusty assistant Lucille begging for Flagstar contacts & email addresses.

I set my alarm for 5am, because thats 8am in MI, when Flagstar opens. I fall asleep praying.

I wake up at 5am & see that 12 friend tweets later, I have a DM from Flagstar that someone ‘will call me’. Excellent. Waiting. Desiree also emailed me back at 3am wanting more details. I sent them to her at 5am.

At 7am I call one of my clients and ask him to call Flagstar again & plead. We still don’t have resolution, & this sale is happening in 6 hours.

Desiree Patno calls me at 8am & gives me her contacts. YES….now I have two email addresses, and one appears to be a C level! Score for Women in the Housing & Real Estate Ecosystem being a truly VALUABLE resource to be a part of. If you’re a female reading this, join NAWRB. Now we’ve got real progress. I send both of them LinkedIn connection requests with a private message.

Another outside consultant who is an attorney advised me I must get a Flagstar email, and CC all, not just all the attorneys. He said copy EVERYONE on EVERYTHING. I usually hate doing that, but I do know it’s effective in knowing exactly where the buck stopped for accountability. I’ll do whatever I have to in order to get this closed, I can’t have a foreclosure looming on my record, or my heart, for that matter.

I send an email to Zieve & CC the new Flagstar emails, even though I have no idea if they can help or not. Zieve, Broadnax & Steele reply VERY quickly. Ooh, we must be on to something here. We have a few more back & forth & they try to take the Flagstar email addresses off the string. I add them right back on. It’s 10am and we are still going back & forth without resolution, but making small steps of progress. Will it be enough, though?

Meanwhile…Still pelting Twitter. I try CCing OC Register, Orange County Association of Realtors, and use #homeownershipmatters. This is what you call ‘making a stink’. Why haven’t they called me back yet??? Will @flagstar be a zero or a hero????? Is it seriously going to end like THIS?

11:08am Flagstar’s C level Alessandro Dinello accepts my LinkedIn request. No response, but I know he read it, and that’s all I needed. Someone who can make a decision to press a button.

At 11:57am I receive a call from David Woods with The Office of the President at Flagstar Bank. They advise me they cannot speak to me unless I get a client on the phone. I call him, no answer. I call her, no answer. SERIOUSLY??! I text him & ask the nice man on the phone if I can try to call him again. He finally picks up, and confirms it’s ok to speak with me. The Flagstar person explains that because of Twitter, our case was escalated to the Office of the President and it is now being constantly monitored. We explain to him that we need Flagstar to advise the attorneys at Zieve to postpone the sale. He says he won’t keep us in suspense any longer, that they have just done this, and will give us a 7 day extension. I would have cried of happiness but my client was still on the phone. I receive an email from Zieve while David was still on the line that they have received the request to postpone the foreclosure, and will oblige. I tell David he is my hero, and I get his direct contact info as he promises to quarterback any lagging parties for me. I wish I could find him personally on social but I can’t find him anywhere?! Regardless, I tweet out a success & thank you to my social outlets, so everyone knows Flagstar did the right thing.

At 11:57am I receive a call from David Woods with The Office of the President at Flagstar Bank. They advise me they cannot speak to me unless I get a client on the phone. I call him, no answer. I call her, no answer. SERIOUSLY??! I text him & ask the nice man on the phone if I can try to call him again. He finally picks up, and confirms it’s ok to speak with me. The Flagstar person explains that because of Twitter, our case was escalated to the Office of the President and it is now being constantly monitored. We explain to him that we need Flagstar to advise the attorneys at Zieve to postpone the sale. He says he won’t keep us in suspense any longer, that they have just done this, and will give us a 7 day extension. I would have cried of happiness but my client was still on the phone. I receive an email from Zieve while David was still on the line that they have received the request to postpone the foreclosure, and will oblige. I tell David he is my hero, and I get his direct contact info as he promises to quarterback any lagging parties for me. I wish I could find him personally on social but I can’t find him anywhere?! Regardless, I tweet out a success & thank you to my social outlets, so everyone knows Flagstar did the right thing.

The attorneys at Zieve, Broadnax & Steele sent the extension and updated payoff demand to Corinthian as Flagstar advised them to do. Corinithian closed the deal by the end of the day now that they had the miracle documents they requested of us. All that work just to buy a few needed hours of time.

Reflecting back, I honestly don’t know if this was saved by Twitter, or by NAWRB email contacts, by random attorneys calling Zieve for me, or a combo of all of the above. I DO know the grace of God was definitely involved!!!!

I want to take a moment to thank the following people who helped me on Twitter, please consider following them:

If you are an agent, know that Twitter is your secret weapon when you’re fighting foreclosure. It’s like Yelp though, you have to be in the space already to get somewhere. Signing up for a twitter account on foreclosure day won’t cut it. You’ll need your army of followers to help you out.

If you’ve found this post helpful or resourceful, please comment! If you’ve got more foreclosure delay tactics, please comment those as well. If you need help fighting foreclosure, do NOT wait, text Angie at 949-338-7408 immediately. This one was saved with one hour and 2 minutes to spare, maybe we can save yours too!

It all started with an incorrect payoff demand that had Friday’s date instead of Monday or Tuesday. The property auction was scheduled for Tuesday 8/7 at 1pm. The bank HAD to be paid off before that time. Escrow brought this to my attention the previous week, stating the attorneys who were acting as the trustees for Flagstar Mortgage were not getting them the updated payoff demand. For the record, the buyer was SUPPOSED to bring his funds to escrow on Friday, but he was ‘too busy’. Gee, thanks. Attorneys moving slow, cash investors moving slow…us prodding cattle.

It all started with an incorrect payoff demand that had Friday’s date instead of Monday or Tuesday. The property auction was scheduled for Tuesday 8/7 at 1pm. The bank HAD to be paid off before that time. Escrow brought this to my attention the previous week, stating the attorneys who were acting as the trustees for Flagstar Mortgage were not getting them the updated payoff demand. For the record, the buyer was SUPPOSED to bring his funds to escrow on Friday, but he was ‘too busy’. Gee, thanks. Attorneys moving slow, cash investors moving slow…us prodding cattle.

At 11:57am I receive a call from David Woods with The Office of the President at Flagstar Bank. They advise me they cannot speak to me unless I get a client on the phone. I call him, no answer. I call her, no answer. SERIOUSLY??! I text him & ask the nice man on the phone if I can try to call him again. He finally picks up, and confirms it’s ok to speak with me. The Flagstar person explains that because of Twitter, our case was escalated to the Office of the President and it is now being constantly monitored. We explain to him that we need Flagstar to advise the attorneys at Zieve to postpone the sale. He says he won’t keep us in suspense any longer, that they have just done this, and will give us a 7 day extension. I would have cried of happiness but my client was still on the phone. I receive an email from Zieve while David was still on the line that they have received the request to postpone the foreclosure, and will oblige. I tell David he is my hero, and I get his direct contact info as he promises to quarterback any lagging parties for me. I wish I could find him personally on social but I can’t find him anywhere?! Regardless, I tweet out a success & thank you to my social outlets, so everyone knows Flagstar did the right thing.

At 11:57am I receive a call from David Woods with The Office of the President at Flagstar Bank. They advise me they cannot speak to me unless I get a client on the phone. I call him, no answer. I call her, no answer. SERIOUSLY??! I text him & ask the nice man on the phone if I can try to call him again. He finally picks up, and confirms it’s ok to speak with me. The Flagstar person explains that because of Twitter, our case was escalated to the Office of the President and it is now being constantly monitored. We explain to him that we need Flagstar to advise the attorneys at Zieve to postpone the sale. He says he won’t keep us in suspense any longer, that they have just done this, and will give us a 7 day extension. I would have cried of happiness but my client was still on the phone. I receive an email from Zieve while David was still on the line that they have received the request to postpone the foreclosure, and will oblige. I tell David he is my hero, and I get his direct contact info as he promises to quarterback any lagging parties for me. I wish I could find him personally on social but I can’t find him anywhere?! Regardless, I tweet out a success & thank you to my social outlets, so everyone knows Flagstar did the right thing.

Real Estate Collaborative Specialist – Divorce

Real Estate Collaborative Specialist – Divorce Scenario 2: “It’s ok, I’ll just go buy another house.”

Scenario 2: “It’s ok, I’ll just go buy another house.”

Vow2Save

Vow2Save

With Memorial Day around the corner we wanted to help you with one of your most precious items to move – MEMORIES! We have just the company to help you keep all those memories and pictures safe during a move.

With Memorial Day around the corner we wanted to help you with one of your most precious items to move – MEMORIES! We have just the company to help you keep all those memories and pictures safe during a move.

This blog post comes from deep in the country of MI, a little township called Richmond. My grandparents have owned property there since before I was born, and two years ago my sister, cousin, & I purchased their 10 acres of land; because it is ‘Our Happy Place’. Recently we received a postcard invitation to attend a town hall meeting & have a discussion on whether or not Richmond residents will ‘opt in’ to any or all aspects surrounding Canna-biz.

This blog post comes from deep in the country of MI, a little township called Richmond. My grandparents have owned property there since before I was born, and two years ago my sister, cousin, & I purchased their 10 acres of land; because it is ‘Our Happy Place’. Recently we received a postcard invitation to attend a town hall meeting & have a discussion on whether or not Richmond residents will ‘opt in’ to any or all aspects surrounding Canna-biz. Of course, family is a huge concern. People didn’t want to expose ‘that’ to their children. Others felt their children might get lured into a world of addiction. Yikes & no thanks! But is that really what’s happening out there? Are we setting up our kids to fail? Here’s an article from the Washington Post that states 12th grade kids in Colorado are no more likely to engage in the ganja than they were before.

Of course, family is a huge concern. People didn’t want to expose ‘that’ to their children. Others felt their children might get lured into a world of addiction. Yikes & no thanks! But is that really what’s happening out there? Are we setting up our kids to fail? Here’s an article from the Washington Post that states 12th grade kids in Colorado are no more likely to engage in the ganja than they were before. Another comment made by some folks at the meeting is they did not want to drive in their beautiful town & see the landscape all changed up with mega-sized industrial and commercial grow buildings. Richmond does pride itself on being stuck in time, and it’s honestly one of the things I love about it. I am seeing these enormous commercial buildings purchased frequently in CA’s Inland Empire, but in MI they would need to be built or we could repurpose existing eyesores. This means that proactive towns have the opportunity to define what that looks like. If you’re in an area having this debate – get involved & voice your opinion so you don’t end up with a green dispensary next door! My suggestion for MI: make it look like a barn. And if you want to talk about EYESORES….how bout you do something about your real barn that has been falling down plank by plank for the last 20 years??? (just sayin, ppl)

Another comment made by some folks at the meeting is they did not want to drive in their beautiful town & see the landscape all changed up with mega-sized industrial and commercial grow buildings. Richmond does pride itself on being stuck in time, and it’s honestly one of the things I love about it. I am seeing these enormous commercial buildings purchased frequently in CA’s Inland Empire, but in MI they would need to be built or we could repurpose existing eyesores. This means that proactive towns have the opportunity to define what that looks like. If you’re in an area having this debate – get involved & voice your opinion so you don’t end up with a green dispensary next door! My suggestion for MI: make it look like a barn. And if you want to talk about EYESORES….how bout you do something about your real barn that has been falling down plank by plank for the last 20 years??? (just sayin, ppl) The saddest moment of the meeting to me was when a Veteran stood up and said he was a medical cannabis patient and he truly tried every ‘drug’ to help the anxiety until he came across marijuana. He said marijuana helped him heal & he encouraged the attendees to view it as medicine. Another VA had the nerve to speak up & say he went to war too & didn’t need any of that. To me….how dare any of us judge what heals another. I was tempted to stand up and shout that the real poisonous drugs were the Big Pharma ones in everyone’s medicine cabinet…but that would not have went over well hahaha! Baby steps people… Start by watching

The saddest moment of the meeting to me was when a Veteran stood up and said he was a medical cannabis patient and he truly tried every ‘drug’ to help the anxiety until he came across marijuana. He said marijuana helped him heal & he encouraged the attendees to view it as medicine. Another VA had the nerve to speak up & say he went to war too & didn’t need any of that. To me….how dare any of us judge what heals another. I was tempted to stand up and shout that the real poisonous drugs were the Big Pharma ones in everyone’s medicine cabinet…but that would not have went over well hahaha! Baby steps people… Start by watching

Every year we make a point to attend the annual OCR meeting. This 3 hour event is filled with great information about what’s happening in our association and community, and it helps us stay on the pulse of the everchanging real estate market.

Every year we make a point to attend the annual OCR meeting. This 3 hour event is filled with great information about what’s happening in our association and community, and it helps us stay on the pulse of the everchanging real estate market.

Hey everyone!

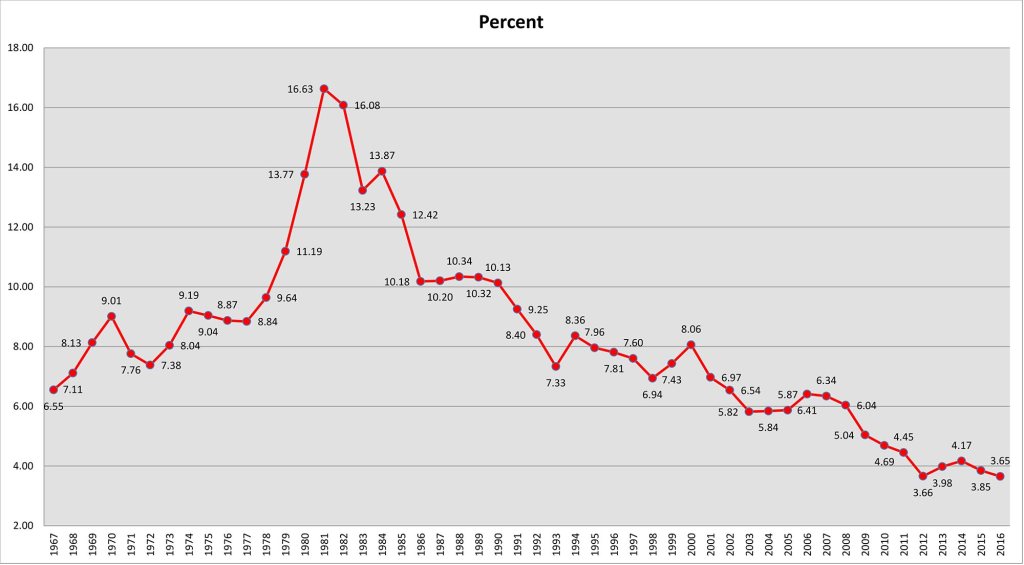

Hey everyone! Tony doesn’t believe we’re in another bubble, so this is our new normal in Orange County. The median sales price is now $800K. The prices continue to creep so high because of inventory, inventory, inventory. People are staying in their homes longer and longer. It also costs more to build here in OC, so that pushes up new home prices.

Tony doesn’t believe we’re in another bubble, so this is our new normal in Orange County. The median sales price is now $800K. The prices continue to creep so high because of inventory, inventory, inventory. People are staying in their homes longer and longer. It also costs more to build here in OC, so that pushes up new home prices. We’ve basically de-incentified homeownership and charity, which IMO sucks. The good news is that millennials still see the value in Homeownership and they are pretty darn charitable anyway 🙂 45% want to buy homes in the next 5 years. It’d be cool if we could vote for more benefits to support homeownership incentives in the future you guys! Follow NAR’s

We’ve basically de-incentified homeownership and charity, which IMO sucks. The good news is that millennials still see the value in Homeownership and they are pretty darn charitable anyway 🙂 45% want to buy homes in the next 5 years. It’d be cool if we could vote for more benefits to support homeownership incentives in the future you guys! Follow NAR’s