Home Seller Tips

The Rest of 2023 in OC – What Should Homebuyers & Sellers Expect?

As we delve into the second half of 2023, we must base our expectations on solid data rather than opinions or noise. Following the market and analyzing reliable data sources is key to understanding the projected trends. One such valuable resource is Reports on Housing, which offers an insightful analysis based on robust statistical information. Recently, Steven Thomas of Reports on Housing shared his perspectives on the Orange County 2023 real estate market during a visit to our Newport Beach office. Let’s explore some of the key takeaways from his presentation.

Interest Rates and the Debt Ceiling: Interest rates continue to be a significant factor impacting the current real estate market. The debt ceiling presents a challenge to the economy. In the past, when the debt ceiling was reduced in 2011, the market experienced an immediate boost. Therefore, there is hope that the Federal Reserve will take measures to address the debt ceiling again. It’s worth noting that when short-term rates rise, long-term rates often decline.

Defining the New Normal: We are still in the process of settling into the “new normal,” and this is evident in the real estate market. Buyers are capping their purchase prices lower than what was observed in 2020 and 2021. This adjustment reflects the evolving market conditions and buyers’ response to affordability and changing interest rates.

Commercial Market Impact: Unlike the residential market, commercial real estate is expected to experience a downturn due to different loan terms. However, residential sales currently maintain the lowest delinquency rate since the inception of Reports on Housing’s tracking. Barring any major incidents, there is no expectation of a short sale or foreclosure market in the near future for the residential market. Commercial real estate is projected to have a much bumpier road.

The “Slowcession” and Interest Rates: Rather than predicting an upcoming recession, Steven coined the term “Slowcession” to describe the anticipated economic environment. This slowcession would involve interest rates ranging from 4.75% to 5.75%. Presently, rates stand at 7%. Economists generally agree that interest rates will eventually decrease; the question is when. Hence, it is advisable to focus on finding the right house while keeping an eye on interest rate fluctuations. The target will continue to move.

Tandem Relationship: 10-Year Treasury and Mortgage Rates: A noteworthy insight from Steven is the 50-year tandem relationship between the 10-year treasury and mortgage rates. Monitoring the 10-year treasury can provide valuable insights into the future direction of interest rates, as the two usually dance together.

No Financial Crisis Expected: Statistics also express consumer confidence that a financial crisis is not imminent. Although some regional banks may undergo absorption, this is considered a typical occurrence in the industry. Recent bank runs have not seriously impacted our Orange County real estate market.

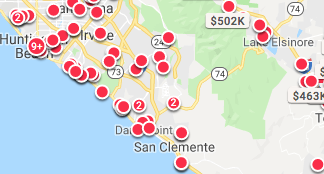

Supply Crisis and Price Stability: The current real estate market in Orange County faces a supply crisis, with historically low inventory levels. Even during the lockdown period, there was more inventory available than there is now! This scarcity of available homes is the main reason prices remain high despite the increase in interest rates. The peak of available inventory is expected in July, after which it will continue to decrease.

Opportunities for Buyers: It is currently advantageous, but an uphill battle, to be a buyer in today’s OC market. Renters, in particular, should consider transitioning to homeownership, as paying rent does not contribute to building equity. High rates have sidelined some buyers, so competition is not as fierce as in 2020-2022. But there is still plenty of competition, in fact, at least 2 buyers statistically for every home available. It is expected if interest rates decline in the future, it will attract more buyers back to the market, resulting in increased competition. Therefore, it’s advisable for potential buyers to act promptly and capitalize on the current conditions…there are not necessarily sunnier skies for buyers in the near future.

Sales Cycles and Demand: The typical sales cycle in Orange County follows a pattern: spring is the best time for sellers, followed by summer. It’s ALWAYS safest to be in escrow by July 31st, as fall is the third most active season, and winter is relatively slower.

Buyer Trends: Currently, buyers are more focused on securing favorable loan terms rather than their dream home, and logic often outweighs desire. Entry-level homes are highly sought-after, but bidding wars make it challenging for buyers to acquire them. Balancing the market would require an increase in inventory to accommodate the demand from millennials and compete with downsizing boomers. Buyers are ‘playing it safe’ and frequently purchase a bit below the level they qualify for.

Affordability and Market Time: The average median payment for California properties historically stood at $3,590 per month. Presently, that figure has risen to $7,290 per month. This dramatic increase highlights the reduced affordability caused by rising prices and interest rates. Additionally, the market time for Orange County properties is currently at 39 days, indicating an intense seller’s market, though less severe than the previous year. Somehow buyers are still absorbing current prices.

The second half of 2023 is expected to outperform the same period in 2022, with an increase in sales predicted for 2024. Both buyers and sellers need to maintain the right mindset and exercise patience in this dynamic market. Rental demand remains high, and rents are unlikely to decrease, making homeownership an appealing long-term investment. If you know someone who is renting, encourage them to explore the benefits of owning real estate and building equity. You can always reach out to Angie at 949-338-7408 for guidance & tools!

By focusing on reliable data and insights, we can project the real estate market for the rest of 2023. Steven Thomas’s presentation provided valuable charts & perspectives on the Orange County market, emphasizing the importance of monitoring interest rates, addressing supply crises, and making informed decisions as buyers or sellers. As the year progresses, maintaining a patient and adaptable mindset will be crucial for navigating the ever-evolving real estate landscape.

Ready to navigate the 2023 real estate market? Whether you’re a buyer or seller, seize the current opportunities and make informed decisions. Connect with us today to get expert guidance and achieve your real estate goals. Don’t miss out on the potential benefits awaiting you in the market. Fill out the form below or text for an appointment:

2021 Real Estate Market Predictions for Orange County, CA

Today one of our favorite forecasters, Steven Thomas, gave his thoughts on closing out the crazy 2020 Covid real estate market and what we expect to see here in 2021. If you love stats, be sure to subscribe to our email list, as we send out Reports on Housing statistics monthly. These reports will keep you on top of exactly what is happening right now with property prices, average days on market, and demand.

We’ve had a really interesting year in real estate, almost flipped from our normal Orange County trends. We were slower in the spring, obviously due to quarantine and virus setbacks (coined ‘The Pandession’). Then we heated up in summer and are still going strong here in fall, when things usually cool.

The pandemic really made people think about what they wanted in a home. And now, they are going out to get it. Sometimes it’s a larger yard, other times a pool, being closer to loved ones, or relocating to a rural environment. Change is brewing in all levels of our housing market.

2020 has seen a SURGE in Luxury demand and sales, and we are seeing it in our team deals as well. Here’s a visual for a better picture:

Demand far outweighs supply, so almost every listing is selling with multiple offers at this point in time. Will it continue? Read on…

One of the factors that will affect our market significantly is Coronavirus numbers and which way they are swinging. If we end up in quarantine again, it WILL affect all markets, including housing, so keep that wild card in mind as we enter into 2021.

Foreclosure Predictions for 2021

Should you be worried about foreclosures? Waiting for that screaming deal on one??? Not really. Less than 6% of homeowners are on forbearance or late on their mortgage. That’s not enough to create a ‘foreclosure wave’…even if ALL of them get foreclosed on. This chart helps to tell part of the story. In 2006, owners didn’t have much equity. In 2020, owners have a LOT of equity.

Due to this equity, the forbearance options, and the rates driving buyers, Steven does NOT expect any wave of foreclosures in 2021.

What about the Rental Moratorium?

Approximately 20% of renters are late on their rent. At first that number seems like WOW…but…rewind to Oct 2019… and the tardy-on-rent number was ALSO…20%. So landlords aren’t hurt that bad, even though renters are on a break until Jan 31st 2021 with the rental moratorium here in the state of California.

Will Housing Demand Stay High in 2021?

Demand is strongest it’s been since Sept 2012 – eight years. If you think we’ve been busy hustling homes, this year is even busier. Demand is expected to slightly drop during the holiday season for November and December, but it will still be higher than the last 8 years. If you have a home to sell before Dec 31st – get in touch – it’s totally a possibility!

Inventory is the lowest it’s been since 2013 – pushing the average days on the market in OC to under 40. A hot seller’s market is under 60 average DOM….so we are in a hot HOT seller’s market, which not even the election division is extinguishing.

Should I buy a home in OC before 2021?

Short answer: Yes. Interest rates are LOW. Demand is high. Prices continue to go up. Lucky for our buyers, even with these prices.. the payment is more affordable than it would have been a few years ago. Check out this comparison:

Interest rates drive affordability. Right now your payment is SO affordable. If you can qualify to buy, it is a fabulous time to make a purchase. In Steven’s words…’You’ll be kicking yourself if you don’t’ LOL. We know, you don’t have the down payment saved. But let’s have a conversation with a parent or grandparent who has equity, or get you crowdfunding your down payment with Vow2Save.

2021 Forecast according to Reports on Housing

Uncertainty with Covid, vaccines, Washington DC, travel, and employment can all make things sticky. If we continue to experience the same demand, things can get sticky.

- Prediction: Real estate will enter 2021 strong and remain that way for at least half the year.

- Prediction: Appreciation 4-7%. Prices are NOT expected to go down at all in 2021

- Prediction: Upper ranges will continue to rise

- Prediction: Closed sales should double what they were in 2020. (from 4 to 8%)

Want to stay up to date on the Orange County real estate market? Simply fill out the form below and we’ll start sending you Steven’s Reports on Housing via email!

History and Current Rules of Fair Housing

It’s important to remember and understand where we have been, to have the best future possible. Today I had the pleasure of attending Young Professionals’ Network webinar on The History of Fair Housing.

Equality is an important topic of discussion in our country right now. One of the best ways we can honor our Constitution stating ‘all men are created equal’ is through housing.

For the purpose of learning and growing, let’s start with a summary of

Where we went wrong with discrimination in housing:

- ‘Men’ in the quote above meant white men who owned property; not women, nor men of color

- Real Estate boards prohibited women or blacks in the early 1900’s

- Redline (racially segregated) areas where residents could not get a mortgage were established

- Racially restrictive CC&R’s

- Federal Fair Housing Act was not passed until 1968

- Realtor Code did not prohibit discrimination until 1974 (that’s under 50 years ago…)

- Protected class of marital status only recognized since 2005 in California

- Gender identity was not protected until 2012 in CA

- AFFA Rule is rescinded in 2020 by POTUS. This took the teeth out of Fair Housing enforcement.

Yes, we went horribly wrong, but there are many ongoing efforts to bring about equal housing in the last few decades and today. This includes lobbying efforts from the National Association of Realtors, and California Association of Realtors to bring back the important elements in AFFA.

Did you know that nationwide there are 7 Fair Housing protected classes? In CA, there are 24 Fair Employment & Housing protected classes. When it comes to Fair Housing, the greater of regulations apply, not the lesser. So… if you are a landlord in California, you have 24 classes to remember to truly make unbiased decisions with your tenants. To help you, there is a new Fair Housing disclosure that is now included in each California purchase or lease agreement.

Sometimes discrimination can be subtle, or without malice. Here are just a few examples of Discrimination in Housing…some may come as a surprise to you.

What Discrimination in Housing Looks Like:

- Treating anyone unequally

- Failing to show a home or lease

- Offering unequal terms

- Advertising specific terms or preference

- Inquiring about a protected status

- Refusing to accomodate a disability (aka emotional support animals)

- Denying a family with children’s offer because you don’t think your pool or busy street is safe for them

- Refusing to rent an upper unit to an elderly tenant because you feel stairs are too dangerous

- Showing preference for one protected group above another (i.e. preferring a family with children over a gay couple)

- Not renting the home to a family with multiple kids because ‘the children will destroy the home’.

- Not treating everyone with the same professional courtesy (greetings, returning calls, tonality, response time)

- Buyer or agent ‘love letters’; especially those with photos

Up until this year, I was an agent sending & receiving love letters. I had no idea they were an indirect method of discrimination; and our stories previously helped my clients get the deal. 2020 brings about many changes, and I am happy to adjust course to assist in offering a better opportunity for all. Please, encourage other professionals in the industry and owners to practice making selling and leasing decisions based on criteria that does not exclude. I will recommend future sellers do not read letters during the decision making process. We can all improve from here and be better at this.

Here’s an interesting infographic with the most common Fair Housing complaints from 2018:

If you know someone who has been party to discrimination in housing, it’s important to educate, and to speak up. Here’s a link to submit a violation:

The only way we change the cycle and truly offer equal housing to all humans is through a system of ethics, awareness of implicit bias, and accountability measures. Feel free to comment your thoughts or experiences below – let’s bring about some positive acknowledgment to build better, stronger, more diverse communities together.

Read Full Post | Make a Comment ( 1 so far )Endorsed by NAR for Foreclosures and Short Sales

Short Sale & Foreclosure Resource

Struggling to make your mortgage payment?

Today we sharpened our short sale and foreclosure sword – YES, it’s a battle! Armed with a new designation from the National Association of Realtors (NAR); called Short Sale & Foreclosure Resource (SFR), now we’ve got the most recent tools to fight a foreclosure and win.

There’s plenty of talk about a potential foreclosure wave once all the COVID forbearance terms have come to an end.. so its important to stay fresh on bank policies, foreclosure timelines, and tools to use to save your property from foreclosure, right?!

Yes, we made it through the recession of 2007-2011 closing plenty of bank owned properties and short sales, but that was 10+ years ago. Platforms and policies have changed.

REO stands for ‘Real Estate Owned‘, and is a common term for a property that has been foreclosed. REO’s are property the bank comes to own because the borrower defaulted or could not financially afford to remain in the property. As a foreclosure resource, we can help you STOP your property from becoming a foreclosure, and we can also assist banks in selling off their REO inventory.

Who’s involved in distressed property situations

Servicer – who you make your mortgage payment to, they may or may not own your loan.

Investor – beneficiary entity who owns the promissory note & mortgage or deed of trust on a property.

Borrower – party in distress; typically struggling to make payments or need to sell when equity is negative.

Buyer – potential purchaser of the home

GSE – Government Sponsored Enterprises (Fannie Mae, Freddie Mac, and others in the secondary money market)

Important Foreclosure Terms to Know

Deed in Lieu – Involves swapping your keys in exchange for relief on the mortgage. Sometimes this will lead you to a 1099 for the money returned. Never do a deed in lieu before you understand the tax ramifications.

Loan Modification – Loan Mods are a permanent change in one or more of the terms of your loan. These must be approved by the investor, servicer, and you. It typically reorganizes the mortgage into something more affordable so you are able to stay in your home.

Notice of Default (NOD) – Official notice of default, and begins your foreclosure timeline. All borrowers have at least 90 days to bring a loan current after a NOD is filed.

Notice of Trustee Sale (NOS) – Official notice of when the foreclosure or auction will take place.

Foreclosure Sale – The actual sale of the property where the title is transferred. Homeowners become tenants upon sale, and lose rights to property ownership.

What are my options to avoid foreclosure?

There are many, but you need to act fast and regularly. One place to check is the Consumer Financial Protection Bureau (CFPB) to help you resolve any shady practices in your loan.

Another option is HHF – Hardest Hit Fund which has been extended through Dec 31st 2020. This program is in 18 states and it helps struggling homeowners with mortgage assistance.

MakingHomeAffordable.gov has many trusted routes you can take, be sure to research so you know your most up to date options. Here are their current tips to avoid foreclosure.

Furthermore, there are local nonprofits in many areas who can connect you with the right resources to save your home. Contact Angie by text at 949.338.7408 ASAP if you would like an Orange County referral.

Reinstatement vs Redemption period

Reinstatement is the 90 days you have to reinstate your loan after you’ve received your official Notice of Default (NOD). Redemption periods do not apply to all states, and they begin after the property is sold in a judicial foreclosure. California is NOT a redemption state with judicial foreclosures…once the property is sold at auction it is gone.

How long does it take to foreclose on a property?

Every state is different, and has different laws. It usually takes anywhere from 90 days to 3 years, depending on the condition of the market.

Short Sale to Avoid Foreclosure

In order to complete a short sale, you must show hardship. Every bank defines this differently; but it can include illness, job loss / unemployment, divorce, 50+ mile job relocation, business failure or natural disasters.

Most banks have a ‘Short sale package‘ available on their website, and this includes a list of the documents you need to submit in order to be considered for a short sale. Some of the common items requested in a packet are:

Listing agreement

Short sale disclosure form

Listing agreement addendum

Authorization to release info form

Federal & State disclosures

Before you fill out the paperwork above it’s important to check for recourse in your state, or you could owe a tax bill on the amount you’ve been forgiven. If you’re unsure about this, check with your CPA.

Furthermore, you must get approval. Approval is a gift.. even though it doesn’t feel like it 😦 Not only do you need approval from your mortgage company, you’ll also need approval from any and all junior lienholders including 2nd mortgage, HELOC, & other liens. If you do not have approval from ALL liens then the short sale will not happen, which is why you need to communicate with your debtors early and often!

Sometimes additional costs will be paid by the investor, but you have to know how to work this into your Estimated Closing Statement (HUD1).

Short sales and foreclosures are TOUGH to navigate. Please reach out to us if you need help. Angie keeps everything confidential and will always help you with creative thinking so you have the most options with your home. Contact her at 949-338-7408!

Furthermore, Angie would love to connect with Asset managers, outsourcers, distressed property managers, and others in the banking industry who are looking for a quality agent who effectively works bank systems to get REO properties sold.

Read Full Post | Make a Comment ( None so far )

Looking to Buy or Sell a Home? See You January 18th!

8th Annual OC Home Fair

Looking to buy or sell a home? Investment property? Just curious about becoming a homeowner? Renting and want to own? WE have an event for you!

5 OC Home Fair Class Highlights

#2 Finding up to 90K to Buy Your Home – Down Payment Programs

#3 Real People – Real Estate Success Stories

#4 How Student Loan Debt Can Fit Into your Home Buying Picture

#5 Home Buying 101 – Pre-Purchase Counseling

Click here to register, just enter your information and select the class you want to attend!

Homeownership Day 2020 – Register Today!

Looking to buy or sell a home or investment property? Homeownership Day has a class for you!

Our annual Homeownership Day & OC Home Fair is coming soon! We are hosting at Chapman University for the 8th year in a row on Saturday, January 18, 2020.

The Southern California Home Fair is an event open to the community designed to provide home owners, home buyers, renters, and seasoned investors with free, personalized and comprehensive information from some of the leading experts in real estate.

OC Home Fair is for Everybody!

Attendees have a variety of choices from many classes offered throughout 3 sessions  covering a variety of topics! Some of the topics include:hassle-free home buying, investing to be an automatic millionaire, buying a home under your business umbrella, and much more.

covering a variety of topics! Some of the topics include:hassle-free home buying, investing to be an automatic millionaire, buying a home under your business umbrella, and much more.

Twelve classes are available this year, spread out over three sessions – pick from four during each time slot! When you register online at OC Home Fair you are able to choose which class you want to be in during each time slot. Some of the highlighted classes this year include:

- Investing to be an Automatic Millionaire

- What to Expect With New Home Builds

- Buying with Cryptocurrency – What You Need to Know

- How Veterans Buy with Zero Down

Click here to register to attend this year’s OC Home Fair, held Saturday, January 18, 2020!

Zillow Offers: Not The American Dream

Zillow Offers provides sellers the opportunity to “skip the hassle and sell your home directly to Zillow.” Zillow Offers targets sellers who want to sell their property as fast as possible. The houses are sold quick and without the “hassle” of a traditional sell (no open houses, repairs are ‘taken care of’, you chose your move and closing date).

You might have seen Zillow advertised on billboards, commercials, or even on personalized yard signs. Zillow promises sellers an instant cash sale for their homes. It sounds great for sellers on a tight timeline, but what’s the catch?

Zillow Offers Are Below Market Value

While Zillow does provide a fast sale and near-instant cash to the seller, this comes at a cost. While your Zillow Offer is providing you instant cash by cutting out the hassle – you are paying for this convenience by selling your house lower than market value.

Zillow offers you a below market value Zestimate because they are taking on the responsibility of selling, fixing, and putting your home on the market. By selling your home for a lower market value, you are able to sell faster. However, Zillow is able to re-sell your home at the actual market value (after making repairs that were technically paid by you by selling the home for less).

What Your Zestimate Actually Costs You:

Zillow provides you with a Zestimate: the estimated market value. It is not an appraisal. After they provide the Zestimate they factor in information they receive from the seller (recent renovations, the current condition of the home, etc.), the opinion of a local real estate agent and fees. Zillow weighs whether renovations will be needed and the cost of holding and reselling the home. This is important to understand – while you do not have to make the necessary repairs and updates to your home, you are still paying to have those repairs completed (the cost is subtracted from your Zillow Offer).

While Zillow says they’ll take care of repairs these will often be priced above market value. This means you will be paying more for repairs than if you hired a contractor yourself. Additionally, you will not be benefiting from the equity that these repairs will bring to the cost of your home. Which means you are PAYING for the repairs by selling your home for less AND not earning anything from it.

Keep In Mind:

According to Zillow’s Offers page – once the Zillow Offer is confirmed, it may be adjusted when an in-person inspection is performed on the home. Just because you received the offer and it sounds appealing, this amount can still be adjusted.

Once Zillow purchases the home, they will make “necessary repairs and updates” and then put the home back on the market. By taking the burden of preparing your home to be listed off the seller – Zillow will earn the equity on your home (that you paid for).

It is important to note – you will still need an agent to determine an offer when using Zillow Offer. If a seller is represented by an agent and they accept a Zillow Offer, the agent still needs to be paid a commission by the seller based on the agreement between the seller and agent.

Sell Your Home Fast Without Losing Equity

Part of being a homeowner means you have invested in a property that will provide you with a return on your investment when you decide to sell. A fast sale should not compromise your investment and result in a below market value offer. We understand you want to sell your home fast – working with a real estate agent doesn’t mean that is an impossible ask.

Real estate agent commissions are between 5-6%, if you are listing your home for 10-15% less than market value you are spending MORE money. Real estate agents have resources to find you a buyer quickly.

If you are determined to move quickly, work with your real estate agent on setting a price that works for you and a buyer. Working with your real estate agent helps you receive better offers because your Agent is negotiating a deal on your behalf, one that will put money into your pocket! Real estate agents can sell your home quick without compromising your equity in the process.

If you have received your Zestimate and would like to compare the offer to market value, reach out to Angie today at: 949-338-7408. Comment below if you have a Zillow Offer Experience!

Read Full Post | Make a Comment ( None so far )Assuming A Property After The Death Of A Relative

Losing a relative can be a very difficult time. We are very sorry for your loss. As you are figuring out your next steps, you may have questions about handling existing mortgage affairs. It is important to remember that you have options and we are here to help you consider the best options for your situation. An assumable mortgage is a home loan that can be transferred from the original borrower to the subsequent homeowner.

Determine if you are permitted to assume the loan

Not all mortgages are assumable – you can check the language in your note and mortgage. Certain types of government-backed loans are easier to assume than conventional loans. Typically you must meet the qualifications of the government agency in order to assume the loan. If you are not sure if you qualify – check with the lender of the loan as well as a real estate professional and a lawyer to ensure you will assume the loan properly.

Lean on professionals to help you determine if you should assume the loan

There are many benefits when assuming a mortgage. When you assume the mortgage, you keep the interest rate that the original owner had on the loan. This could increase the marketability of the property especially in a market where interest rates might be rising. Assumptions typically take less time. If you were listed on the note or in the trust agreement, the process could take only 30 days.

A properly recorded deed is public record. This means once an individual inherits the property – it becomes public record if a trust agreement was not in place. It is important to stand by your trusted professionals during this time to ensure you make the best decisions for you and your family. Offers will come your way that might encourage you to sell the home, it is important to make this decision based on what is best for you. Making sure you have the right people beside you during this difficult time is crucial to ensuring you make the best financial decisions.

Decide if selling the property would benefit you

It is important to remember that you have options. Selling the home might seem appealing and marketable however owning the home could provide an income for your family. Assuming the mortgage allows you to inherit a property at a lower cost, with potentially lower interest rates. If you assume the loan, you will have to pay taxes and assumption fees. While selling the home provides you with an advantage as a seller (lower rates, quicker closing) you could lose a valuable asset. Assuming the mortgage provides you with an opportunity to use the property as an investment. If you do not wish to reside in the home, you could consider using the property as an investment to provide a monthly income to you and your family. Real estate is an imperishable asset with an increasing value. You can learn more about how to turn a property into a source of income here.

If you have additional questions and are seeking help from a trusted professional, contact Angie at 949-338-7408. You can also fill out a contact form if you would like to discuss how you can begin the process of assuming a mortgage!

Read Full Post | Make a Comment ( None so far )Tis’ the Season – it’s now an even Market in Orange County

Finally a NORMAL market in OC

If you are have been considering buying, but were reluctant due to the market – the times have changed! For the first time in 7+ years, our market in Orange County is even. This makes it a great time to consider buying, especially because we never know how long it will last. For quite a while it has been a sellers market due to low inventory of houses. This left buyers frustrated due to not being able to find the home they had been dreaming of. Many people were putting multiple offers in on whatever homes were available even if it wasn’t their dream place, just to be turned down because of all the competition in the market. This Spring it quickly started to become a more balanced market where both sellers and buyers had the opportunity to be successful. The active inventory has more than double this year, which is the fastest the market has changed since 2008. This does not necessarily mean it is favoring buyers more than sellers now, but is much more favorable towards buyers than it had previously been which is a huge plus for Orange County and clients who have been wanting to buy for awhile.

Until this Spring, houses were flying off the market at higher than normal prices due to demand, now this is what is sitting on the market due to the change in demand.

Luxury homes are still in demand

Even though it is a much more balanced market at the moment, luxury homes are still being sought out for and there isn’t enough inventory for those luxury buyers. Anything over $1.25 million is needed in the market. Every year luxury demand goes down a little more. So all our luxury owners who are reading this – its your time to make the most money for your home, and possibly upgrade to something even more luxurious 😉

Importance of listening to your Realtor

You all know that we are always advising to find a good real estate agent and sticking with them and their advice, this has not changed. We think it is so important for both buyers and sellers to be properly represented in order to give them the most smooth home purchasing or selling experience. In a balanced market it is almost more important to really listen to your Realtor. We have become so accustomed to the market we have been stuck in that people have a hard to adjusting back to a normal market. In a more balanced market there is no room for error, which is when a Realtor really comes in handy. In a sellers market it is easier to stretch the price because buyers are desperate, but in an even market overpricing leads to failure. It is important to have a Realtor help you decide on upgrades and pricing. Careful and well thought pricing is crucial for the remainder of the year now that it is no longer a sellers market.

If you would like to subscribe to regular market reports, email us at successinweeks@gmail.com. If you are interested in selling or buying a home in the new balanced market, contact Angie at 949-338-7408 so she can help you with all your real estate needs.

Read Full Post | Make a Comment ( None so far )Homeownership and Divorce: What To Do About Your House

The evil D word, nobody wants it, but it happens to 50% or more of us. Orange County sky rockets the national divorce average from 50% to 72%. Did you know that divorces spike in August and January? As summer winds down, we thought it would be a good idea to give you some pointers on this super touchy subject.

Listing your home during a divorce

MANY of our listings are divorce sales, and we strive to provide solutions to better protect our clients. It’s a HARD time, and we want to make it as easy as we can when it comes to the most important asset. For this reason, I just earned my RCS-D designation with Professor Kelly Murray, who has degrees from Stanford & Harvard Law. Watch this video to find out some important tips to a successful resolution of the house during a dissolution:

Real Estate Collaborative Specialist – Divorce

Real Estate Collaborative Specialist – Divorce

Did you know that less than 50 Realtors in Orange County, CA have this prestigious designation? Did you know the standard in divorce when it comes to real estate is an appraisal and a mortgage statement?? That’s IT.

- NO inspection reports

- NO previous title search for liens or secret mortgages

- NO insurance search to confirm the property can be refinanced

- NO preapproval to make sure the home can *actually* be refinanced by one party or the other on their own

Property division is permanent, and not all divorce attorneys are stellar when it comes to real estate handlings. Things you sign in mediation are binding, and sometimes you feel rushed into these decisions. CONTACT US for a no obligation conversation on how you can protect yourself before you ever walk into court or mediation.

Hard Scenarios You MUST Consider During Divorce

Scenario 1: “Oh, just let them keep the house.”

Are you sure about that? One late payment can be 100 credit points! Do you care about your credit score? Ask yourself: Can you or your ex ACTUALLY qualify for the refinance?

- For example: Can you use your alimony or support payments, and if so, how soon? Many banks have a 6/36 rule. They want to see 6 months consistent income, and receive evidence that 36 months of income will continue before they will lend.

Scenario 2: “It’s ok, I’ll just go buy another house.”

Scenario 2: “It’s ok, I’ll just go buy another house.”

ASK: If you allow your ex to keep the house, will YOU still qualify for with your name on the old mortgage? Can you start your next chapter?

- For example: In the eyes of a lender, both parties don’t have 50/50 responsibility on a loan……you each have to pay 100% if the other defaults. Does this ruin your chances of qualifying for a second home in your name? Make it a point to find out before you make a promise you can’t keep.

Scenario 3: “I lost my job / health & I can’t pay.”

Consider what might happen in a worst case scenario. Would you be able to carry two homes to save your credit? Or possibly be willing to sell in a down market?

- UNFORTUNATE FACT: Only 25-30% of individuals regain homeownership 7-10 years after foreclosure. Don’t let your divorce put you into this pool.

If you need help deciding what to do with your house during a divorce talk to the proper Divorce Professionals who can give you the protection, tools, and timeline to make your future a success. We have an entire team waiting to assist you, from moving out all clutter for free to pulling the necessary paperwork to know what you truly owe and own on your properties.

Please reach out to Angie via phone or text anytime at 949-338-7408. Always confidential, always caring, always at your service.

Read Full Post | Make a Comment ( None so far )How to sell your home fast and for top dollar

Thinking of selling your home?

Are you thinking of selling your home but the process seems too overwhelming and hard? Maybe you have already decided to sell your home but aren’t sure about the process and how to get started. The AskAngie team has all of the answers for you in either situation. We know deciding to sell your home is not an easy decision and can be a very stressful time in your life. Most people want to sell it quickly in order to purchase the next place and everyone wants to get the most money they possibly can out of their home. We have all the tips to help you do just that.

Declutter and bring in the light

One tip we always recommend to our clients is to declutter before listing your home for sale. Having a lot of clutter around your home or on counter tops can really take away from the big picture of what you’re selling. Most buyers want to be able to come into your home and picture it as their own in order to decide whether or not they want to make an offer, seeing your items everywhere might make it hard for them to picture themselves and their family living there. We also suggest removing any dark drapes or window coverings to really brighten up the space and make it more approachable to a buyer. Bright areas and natural light catch buyers attention every time.

An example of a light and bright living room

Changing perspective

In order to get top dollar for your home you have to mix it up and change buyers perspective of what they are looking at. One way to do this is using drone photos for your online postings and MLS site. This allows possible buyers to see the area around your home including the neighborhood, parks, or schools nearby. It also provides a different look at the home itself. We also always suggest that our sellers invest in a stager for their home. Making it look its absolute best is a stagers job – and we have some really good ones! This will help you get top dollar because buyers are seeing it at its best.

Without this drone image you wouldn’t be able to see the AMAZING surroundings this home has. What a change in perspective 🙂

Knowing the market

We believe educating yourself via your Realtor about the current market before listing your home is a good way to prepare yourself for what is to come. Being prepared and knowing what you’re up against is a good idea for selling your home quickly. It is currently a sellers market here in the OC, and we are always looking for people wanting to sell their homes. There’s a lot of buyers looking but never enough houses for them to buy. Knowing this information before posting your home for sale can be very motivating and encouraging as you begin your journey with your house on the market.

Bring the whole package from day one!

We always bring our sellers perfect package to the MLS day one of its listing. In order to do this you need a good Realtor, good photos, and be completely ready to sell. If people have online searches saved they are only sent properties via email the day it’s added and if the price drops, because of this you want to have your pictures and postings perfected before it is listed on the MLS. We also provide a property website for each listings that you are able to share on social media and with any buyer who is interested in your property.

29 more home selling tips waiting for you!

These are just a few additional tips that we added on to share with you. but our team has created a report, 29 Essential Tips That Get Homes Sold Fast (And For Top Dollar). If this report is something you are interested in reading or you know someone who is thinking of selling their home and could use some tips just fill out the form below to have it emailed to you! If you need any additional advice or are looking for someone to help you sell your home quickly contact Angie at 949-338-7408!

Organizing Your Family’s OC Move & Memories

Do you have precious memories you want to save digitally?

With Memorial Day around the corner we wanted to help you with one of your most precious items to move – MEMORIES! We have just the company to help you keep all those memories and pictures safe during a move. Mike Helsper and his team at Digital4Keeps organize and digitize photos and paperwork for easier keeping for you and your family. They offer a mobile scanning service that they can do for you in your home or in your office. This is used to archive all your important documents into safer keeping than just inside the drawers of your desk or filing cabinet in your home. Their passion is to preserve your families memories.

With Memorial Day around the corner we wanted to help you with one of your most precious items to move – MEMORIES! We have just the company to help you keep all those memories and pictures safe during a move. Mike Helsper and his team at Digital4Keeps organize and digitize photos and paperwork for easier keeping for you and your family. They offer a mobile scanning service that they can do for you in your home or in your office. This is used to archive all your important documents into safer keeping than just inside the drawers of your desk or filing cabinet in your home. Their passion is to preserve your families memories.

Preserving Memories

Digital4Keeps offers affordable simple flat rate, inclusive pricing, and packages. They have high speed scanning and organize those in a digital format so they are safer. They transfer memories and provide you with a DVD, flash drive or storage on a hard disk for your own computer. They can also touch up photos after scanning to ensure the best photo for safe keeping and offer to introduce clients to the cloud for better keeping. Have greeting cards that need scanning? They do that too.

Safety for Important Documents

They will protect your important documents and files from fires or any other disaster you wouldn’t expect to happen. They do this by scanning and filing your documents so that they are available in the digital world only for you or family members to have a copy of. To see more of what they have to offer check out digital4keeps.com

If you’re about to move and want your things organized before doing so or if you just want to make sure all of your memories and documents are in safe keeping for your future get a hold of Mike Helsper at Digital4Keeps – 714-814-1648.

If you need help finding that next home to make more memories in, we are always honored to assist! Angie’s standing by at 949-338-7408 to help you find the home of your dreams 🙂

Read Full Post | Make a Comment ( None so far )« Previous Entries

It all started with an incorrect payoff demand that had Friday’s date instead of Monday or Tuesday. The property auction was scheduled for Tuesday 8/7 at 1pm. The bank HAD to be paid off before that time. Escrow brought this to my attention the previous week, stating the attorneys who were acting as the trustees for Flagstar Mortgage were not getting them the updated payoff demand. For the record, the buyer was SUPPOSED to bring his funds to escrow on Friday, but he was ‘too busy’. Gee, thanks. Attorneys moving slow, cash investors moving slow…us prodding cattle.

It all started with an incorrect payoff demand that had Friday’s date instead of Monday or Tuesday. The property auction was scheduled for Tuesday 8/7 at 1pm. The bank HAD to be paid off before that time. Escrow brought this to my attention the previous week, stating the attorneys who were acting as the trustees for Flagstar Mortgage were not getting them the updated payoff demand. For the record, the buyer was SUPPOSED to bring his funds to escrow on Friday, but he was ‘too busy’. Gee, thanks. Attorneys moving slow, cash investors moving slow…us prodding cattle.

At 11:57am I receive a call from David Woods with The Office of the President at Flagstar Bank. They advise me they cannot speak to me unless I get a client on the phone. I call him, no answer. I call her, no answer. SERIOUSLY??! I text him & ask the nice man on the phone if I can try to call him again. He finally picks up, and confirms it’s ok to speak with me. The Flagstar person explains that because of Twitter, our case was escalated to the Office of the President and it is now being constantly monitored. We explain to him that we need Flagstar to advise the attorneys at Zieve to postpone the sale. He says he won’t keep us in suspense any longer, that they have just done this, and will give us a 7 day extension. I would have cried of happiness but my client was still on the phone. I receive an email from Zieve while David was still on the line that they have received the request to postpone the foreclosure, and will oblige. I tell David he is my hero, and I get his direct contact info as he promises to quarterback any lagging parties for me. I wish I could find him personally on social but I can’t find him anywhere?! Regardless, I tweet out a success & thank you to my social outlets, so everyone knows Flagstar did the right thing.

At 11:57am I receive a call from David Woods with The Office of the President at Flagstar Bank. They advise me they cannot speak to me unless I get a client on the phone. I call him, no answer. I call her, no answer. SERIOUSLY??! I text him & ask the nice man on the phone if I can try to call him again. He finally picks up, and confirms it’s ok to speak with me. The Flagstar person explains that because of Twitter, our case was escalated to the Office of the President and it is now being constantly monitored. We explain to him that we need Flagstar to advise the attorneys at Zieve to postpone the sale. He says he won’t keep us in suspense any longer, that they have just done this, and will give us a 7 day extension. I would have cried of happiness but my client was still on the phone. I receive an email from Zieve while David was still on the line that they have received the request to postpone the foreclosure, and will oblige. I tell David he is my hero, and I get his direct contact info as he promises to quarterback any lagging parties for me. I wish I could find him personally on social but I can’t find him anywhere?! Regardless, I tweet out a success & thank you to my social outlets, so everyone knows Flagstar did the right thing.