A Divorce team on YOUR side

Going through a divorce is a stressful life event that unfortunately happens to about 72% of us here in Orange County, which is 22% over the national average. It is much more common than we think, and we are never prepared for it because we think we will be together forever. You probably know someone going through one right now. We hope it never happens to you or anyone else we know and love, but if it does we want you to know what you can do to make it easier. Divorce can also be one of the most lonely times for people, losing your best friend that you were going to spend the rest of your life with is far from easy. In order to make the process a little more easy, you need to find yourself a support system and a team that can help you through all of the legal parts that come with.

Who should be on your team?

Divorce Attorney

The last thing you want to think about our deal with during a divorce is what legal matters need to be settled. Having a good divorce attorney in your corner is key to helping it be an easy transition. If you don’t feel like doing research on divorce attorney’s don’t worry, we know the best one. Elisabeth Donovan is a member of our LeTip group that we see every week and we think she would be a great asset to your team. She is a certified divorce financial analyst and divorce attorney so she is at a higher level than other attorneys. She is experienced in separation and divorce, child custody and child support. She is passionate and aggressive, we’d want her on our team if we were in the same situation.

The last thing you want to think about our deal with during a divorce is what legal matters need to be settled. Having a good divorce attorney in your corner is key to helping it be an easy transition. If you don’t feel like doing research on divorce attorney’s don’t worry, we know the best one. Elisabeth Donovan is a member of our LeTip group that we see every week and we think she would be a great asset to your team. She is a certified divorce financial analyst and divorce attorney so she is at a higher level than other attorneys. She is experienced in separation and divorce, child custody and child support. She is passionate and aggressive, we’d want her on our team if we were in the same situation.

Lender

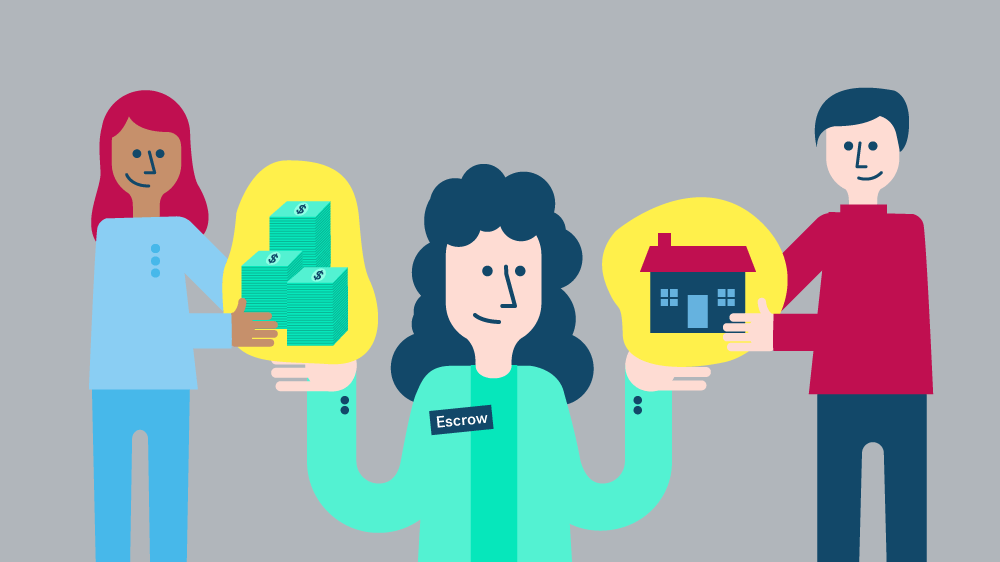

When going through a divorce homeownership and our credit can take a hit. You want a good lender on your side who will make sure you are able to purchase a home again. Derek Beisner is always one of your favorite lenders who also has his divorce designation. When one spouse says; ‘I’ll just keep the house,’ Derek makes sure not only they can afford it, but the spouse leaving can also afford to go off on their own and obtain financing. This is a critical step most divorcing couples forget to handle in mediation, and it usually ends up in one party being forced to sell or foreclose within 6 months to 1 year. We won’t let this happen to you.

When going through a divorce homeownership and our credit can take a hit. You want a good lender on your side who will make sure you are able to purchase a home again. Derek Beisner is always one of your favorite lenders who also has his divorce designation. When one spouse says; ‘I’ll just keep the house,’ Derek makes sure not only they can afford it, but the spouse leaving can also afford to go off on their own and obtain financing. This is a critical step most divorcing couples forget to handle in mediation, and it usually ends up in one party being forced to sell or foreclose within 6 months to 1 year. We won’t let this happen to you.

Title

Sometimes debt gets so high in a separated household that second loans and Home Equity Lines of credit get taken out. Are you aware of everything that owed on your home, and every debt that’s connected to each of you? We have Mike with Team Langgle at your service to do a deep title search on all your assets, AND each party’s social security number, so nothing pesky pops up later. It’s important to know these things when you are dividing your assets equally!

Sometimes debt gets so high in a separated household that second loans and Home Equity Lines of credit get taken out. Are you aware of everything that owed on your home, and every debt that’s connected to each of you? We have Mike with Team Langgle at your service to do a deep title search on all your assets, AND each party’s social security number, so nothing pesky pops up later. It’s important to know these things when you are dividing your assets equally!

Realtor

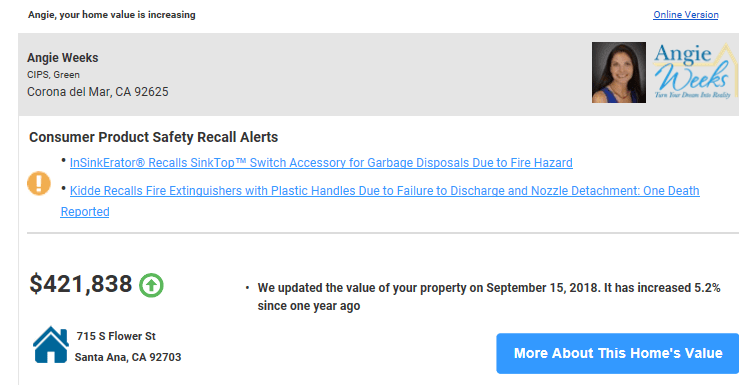

You know us and we weren’t going to leave your real estate agent off of your team. Having your trusted agent in your pocket during this time is so important. Whether you need to work with them to help you both sell your current home or you just need help finding your new home for your new chapter – having a real estate agent you trust and enjoy working with is key. We at the AskAngie team have the heart to help people going through a divorce. We’re not just trying to just sell your home we’re going to research and protect you to ensure you have a right size residence. Yes, sometimes that means sales, but frequently we just help put your ducks in order FOR FREE with no obligations. We work in conjunction with attorneys like Elisabeth to make sure every property concern is covered.

You know us and we weren’t going to leave your real estate agent off of your team. Having your trusted agent in your pocket during this time is so important. Whether you need to work with them to help you both sell your current home or you just need help finding your new home for your new chapter – having a real estate agent you trust and enjoy working with is key. We at the AskAngie team have the heart to help people going through a divorce. We’re not just trying to just sell your home we’re going to research and protect you to ensure you have a right size residence. Yes, sometimes that means sales, but frequently we just help put your ducks in order FOR FREE with no obligations. We work in conjunction with attorneys like Elisabeth to make sure every property concern is covered.

Insurance

Did you know insurance usually goes up on a property after a divorce? Or even worse, some properties are uninsurable due to new guidelines? Charley Hulsey with Pacific Partners Ins Agency can check your home(s) to make sure prices aren’t going up and you don’t get stuck in a pickle later with any insurance issues. If you’ve had too many claims recently, you could be in this boat. Be careful and let us confirm every single one of your bases is covered.

Credit Repair

Divorce can ruin one or both parties credit, and you’re going to NEED good credit to start your next chapter right! Sean Bruce with Executive Fix has flexible 3-18 month programs to help you boost your score back up and bounce back better than ever. Little things can make a big difference with your credit, and you have lots of big things to focus on. Sean cleans up your credit while you’re putting the other pieces back together.

Tax Advice

You may be moving to a new tax bracket or selling your home and paying Capital Gains. Irene Mack, CPA knows everything about the new tax laws and can help you understand what your new tax obligations will be. If you have back taxes owed, she can also assist to set you up with a payment plan. Having any outstanding tax obligations during the years that you were married can fall upon you both for years to come, and Irene can help you resolve that so you don’t have lingering issues.

Trust Advice

Are you breaking up or changing a trust? Rebecca Rainwater of Rainwater Family Mediation, LLC, is an experienced mediator and attorney who can assist you in preparing a trust to protect your assets and properties. She offers a personalized approach to each case and will work with you to create a plan that meets your unique needs.

Financial Advice

Need to change up your investments? Update your beneficiaries? Have fresh eyes take a look to make sure you are making the most out of what you’ve saved? Barbara Loos has been with Prudential for years and will take a look at your current investments with no obligations and let you know if she thinks you’re in a good place or she sees opportunity for bigger gains. Don’t lose sight of your long term plans during this difficult time.

Mobile Notary

With all the documents flying you’re probably going to need a notary, a few times. Nicki Walsh is so kind, caring, and compassionate, you’ll want her to help you with all your paperwork signings. She can come to you or meet you at the place of your choice.

Fix up crew

If you’re selling, renting, or even keeping your home but find out repairs are needed, we’ve got everyone you need to help you from Ken with Beacon Carpet & grout cleaning, to John with Reddel Draperies. Or maybe you don’t need anything ‘fixed’, but you can’t stand looking at the exact same house. Gina Lauren can come help you transform your space with her interior design expertise.

Clutter crew

Oh, and we also have the fasttrack number to Salvation Army. Most people call and it’s 2 weeks out and a 4 hour window…not us. We call and set an appointment TIME where they come and pick up EVERYTHING regardless of condition. It’s all part of our RCS-D designation relationships to bring you one less worry.

Emotional support

Obviously this is such a hard time with so much change. We’ve got you covered on that end too, with referrals for many therapists, help groups, churches, & holistic help practitioners to keep you operating at your best mentally. The more people you can have on your team to share the heavy load during this time will make your life easier and less stressful. Go ahead, lean on us!

Next Steps

Together with your team you will be able to mastermind the next steps of your life and where the new chapter will begin. Your divorce attorney will make sure you get everything you want and need throughout the divorce process. Then your lender and the rest of the team will make sure your credit, savings, and mindset stays strong so that you are able to buy again sooner than later. Lastly, your Realtor will help you find the perfect new pad for your next chapter, and you’ll be well on your way to your best life!

If you need more recommendations/advice or are currently going through a divorce and need our team to be your support system contact Angie at 949-338-7408.

So how can we help international buyers make the most of their money, so they can close easy and afford to pay more for our properties?! One way is

So how can we help international buyers make the most of their money, so they can close easy and afford to pay more for our properties?! One way is

Our annual Homeownership Day & OC Home Fair is right around the corner! We are hosting at Chapman University for the 7th year in a row on January 19th, 2019 from 10 AM – 1 PM!

Our annual Homeownership Day & OC Home Fair is right around the corner! We are hosting at Chapman University for the 7th year in a row on January 19th, 2019 from 10 AM – 1 PM! Participating Nonprofits include NeighborWorksOC and Affordable Clearinghouse – offering a panel on grants, down-payment programs, and more called ‘Finding Funds to Buy Your Home’. If you are currently renting, these nonprofits are here to help YOU! Veterans Association of Real Estate Professionals (VAREP) will also be hosting a class for veterans to take advantage of their housing benefits. Furthermore, Women in the Housing & Real Estate Ecosystem (

Participating Nonprofits include NeighborWorksOC and Affordable Clearinghouse – offering a panel on grants, down-payment programs, and more called ‘Finding Funds to Buy Your Home’. If you are currently renting, these nonprofits are here to help YOU! Veterans Association of Real Estate Professionals (VAREP) will also be hosting a class for veterans to take advantage of their housing benefits. Furthermore, Women in the Housing & Real Estate Ecosystem ( Whether you’re trying to buy your first home, or someone who owns multiple homes but is trying to grow your portfolio or buy internationally, our classes have real life applications to help everyone learn how to establish and grow a residual income stream. There is absolutely no pitching, anything to buy, or programs to subscribe to– just solid information presented by experienced industry leaders.

Whether you’re trying to buy your first home, or someone who owns multiple homes but is trying to grow your portfolio or buy internationally, our classes have real life applications to help everyone learn how to establish and grow a residual income stream. There is absolutely no pitching, anything to buy, or programs to subscribe to– just solid information presented by experienced industry leaders.

The last thing you want to think about our deal with during a divorce is what legal matters need to be settled. Having a good divorce attorney in your corner is key to helping it be an easy transition. If you don’t feel like doing research on divorce attorney’s don’t worry, we know the best one.

The last thing you want to think about our deal with during a divorce is what legal matters need to be settled. Having a good divorce attorney in your corner is key to helping it be an easy transition. If you don’t feel like doing research on divorce attorney’s don’t worry, we know the best one.  When going through a divorce homeownership and our credit can take a hit. You want a good lender on your side who will make sure you are able to purchase a home again.

When going through a divorce homeownership and our credit can take a hit. You want a good lender on your side who will make sure you are able to purchase a home again.  Sometimes debt gets so high in a separated household that second loans and Home Equity Lines of credit get taken out. Are you aware of everything that owed on your home, and every debt that’s connected to each of you? We have Mike with Team Langgle at your service to do a deep title search on all your assets, AND each party’s social security number, so nothing pesky pops up later. It’s important to know these things when you are dividing your assets equally!

Sometimes debt gets so high in a separated household that second loans and Home Equity Lines of credit get taken out. Are you aware of everything that owed on your home, and every debt that’s connected to each of you? We have Mike with Team Langgle at your service to do a deep title search on all your assets, AND each party’s social security number, so nothing pesky pops up later. It’s important to know these things when you are dividing your assets equally! You know us and we weren’t going to leave your real estate agent off of your team. Having your trusted agent in your pocket during this time is so important. Whether you need to work with them to help you both sell your current home or you just need help finding your new home for your new chapter – having a real estate agent you trust and enjoy working with is key. We at the AskAngie team have the heart to help people going through a divorce. We’re not just trying to just sell your home we’re going to research and protect you to ensure you have a right size residence. Yes, sometimes that means sales, but frequently we just help put your ducks in order FOR FREE with no obligations. We work in conjunction with attorneys like Elisabeth to make sure every property concern is covered.

You know us and we weren’t going to leave your real estate agent off of your team. Having your trusted agent in your pocket during this time is so important. Whether you need to work with them to help you both sell your current home or you just need help finding your new home for your new chapter – having a real estate agent you trust and enjoy working with is key. We at the AskAngie team have the heart to help people going through a divorce. We’re not just trying to just sell your home we’re going to research and protect you to ensure you have a right size residence. Yes, sometimes that means sales, but frequently we just help put your ducks in order FOR FREE with no obligations. We work in conjunction with attorneys like Elisabeth to make sure every property concern is covered.