Short Sale & Foreclosure Resource

Struggling to make your mortgage payment?

Today we sharpened our short sale and foreclosure sword – YES, it’s a battle! Armed with a new designation from the National Association of Realtors (NAR); called Short Sale & Foreclosure Resource (SFR), now we’ve got the most recent tools to fight a foreclosure and win.

There’s plenty of talk about a potential foreclosure wave once all the COVID forbearance terms have come to an end.. so its important to stay fresh on bank policies, foreclosure timelines, and tools to use to save your property from foreclosure, right?!

Yes, we made it through the recession of 2007-2011 closing plenty of bank owned properties and short sales, but that was 10+ years ago. Platforms and policies have changed.

REO stands for ‘Real Estate Owned‘, and is a common term for a property that has been foreclosed. REO’s are property the bank comes to own because the borrower defaulted or could not financially afford to remain in the property. As a foreclosure resource, we can help you STOP your property from becoming a foreclosure, and we can also assist banks in selling off their REO inventory.

Who’s involved in distressed property situations

Servicer – who you make your mortgage payment to, they may or may not own your loan.

Investor – beneficiary entity who owns the promissory note & mortgage or deed of trust on a property.

Borrower – party in distress; typically struggling to make payments or need to sell when equity is negative.

Buyer – potential purchaser of the home

GSE – Government Sponsored Enterprises (Fannie Mae, Freddie Mac, and others in the secondary money market)

Important Foreclosure Terms to Know

Deed in Lieu – Involves swapping your keys in exchange for relief on the mortgage. Sometimes this will lead you to a 1099 for the money returned. Never do a deed in lieu before you understand the tax ramifications.

Loan Modification – Loan Mods are a permanent change in one or more of the terms of your loan. These must be approved by the investor, servicer, and you. It typically reorganizes the mortgage into something more affordable so you are able to stay in your home.

Notice of Default (NOD) – Official notice of default, and begins your foreclosure timeline. All borrowers have at least 90 days to bring a loan current after a NOD is filed.

Notice of Trustee Sale (NOS) – Official notice of when the foreclosure or auction will take place.

Foreclosure Sale – The actual sale of the property where the title is transferred. Homeowners become tenants upon sale, and lose rights to property ownership.

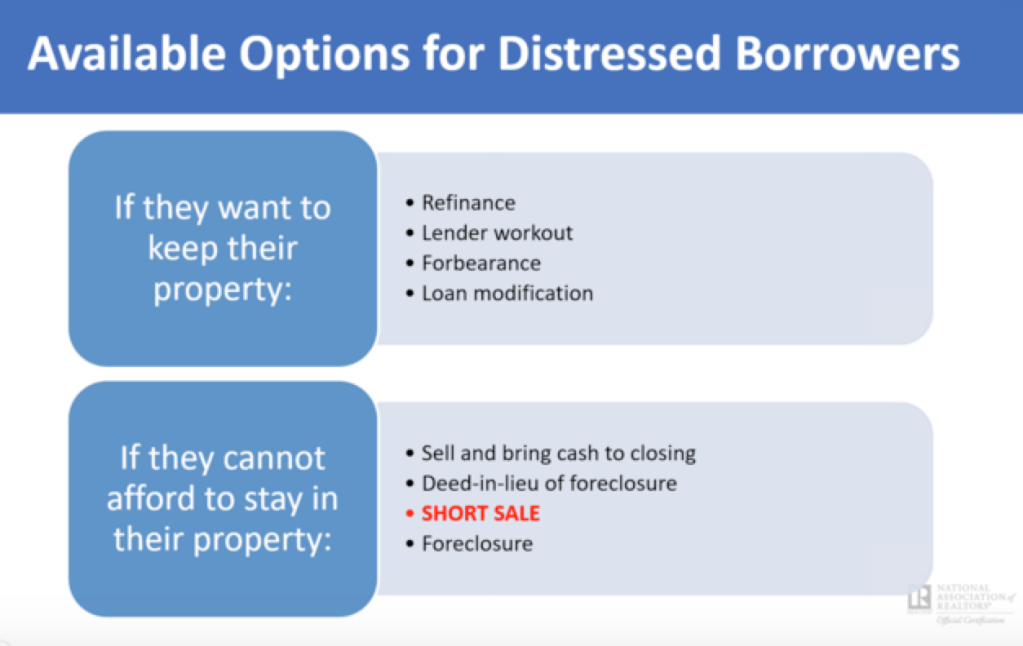

What are my options to avoid foreclosure?

There are many, but you need to act fast and regularly. One place to check is the Consumer Financial Protection Bureau (CFPB) to help you resolve any shady practices in your loan.

Another option is HHF – Hardest Hit Fund which has been extended through Dec 31st 2020. This program is in 18 states and it helps struggling homeowners with mortgage assistance.

MakingHomeAffordable.gov has many trusted routes you can take, be sure to research so you know your most up to date options. Here are their current tips to avoid foreclosure.

Furthermore, there are local nonprofits in many areas who can connect you with the right resources to save your home. Contact Angie by text at 949.338.7408 ASAP if you would like an Orange County referral.

Reinstatement vs Redemption period

Reinstatement is the 90 days you have to reinstate your loan after you’ve received your official Notice of Default (NOD). Redemption periods do not apply to all states, and they begin after the property is sold in a judicial foreclosure. California is NOT a redemption state with judicial foreclosures…once the property is sold at auction it is gone.

How long does it take to foreclose on a property?

Every state is different, and has different laws. It usually takes anywhere from 90 days to 3 years, depending on the condition of the market.

Short Sale to Avoid Foreclosure

In order to complete a short sale, you must show hardship. Every bank defines this differently; but it can include illness, job loss / unemployment, divorce, 50+ mile job relocation, business failure or natural disasters.

Most banks have a ‘Short sale package‘ available on their website, and this includes a list of the documents you need to submit in order to be considered for a short sale. Some of the common items requested in a packet are:

Listing agreement

Short sale disclosure form

Listing agreement addendum

Authorization to release info form

Federal & State disclosures

Before you fill out the paperwork above it’s important to check for recourse in your state, or you could owe a tax bill on the amount you’ve been forgiven. If you’re unsure about this, check with your CPA.

Furthermore, you must get approval. Approval is a gift.. even though it doesn’t feel like it 😦 Not only do you need approval from your mortgage company, you’ll also need approval from any and all junior lienholders including 2nd mortgage, HELOC, & other liens. If you do not have approval from ALL liens then the short sale will not happen, which is why you need to communicate with your debtors early and often!

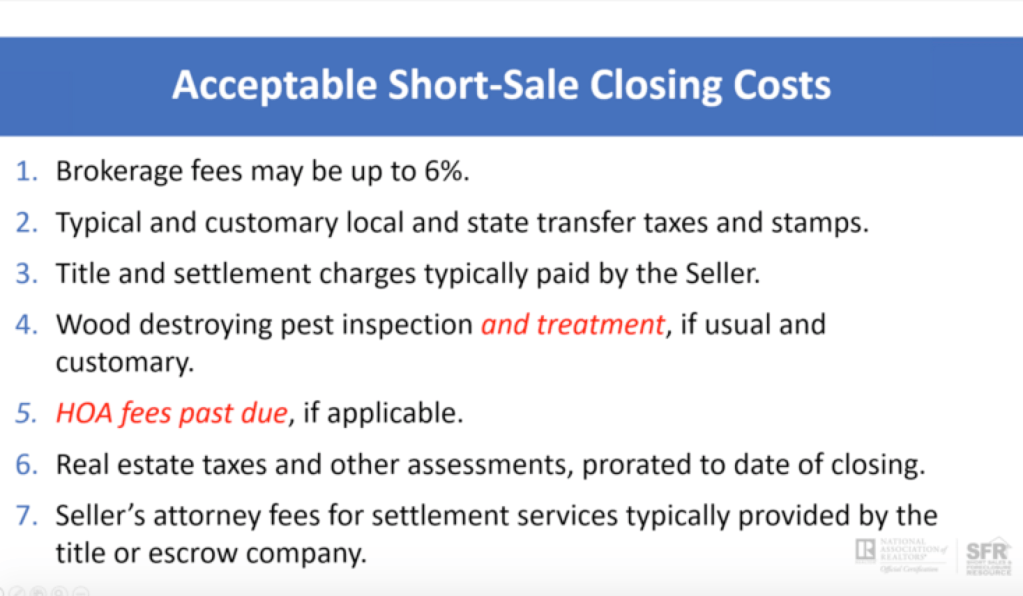

Sometimes additional costs will be paid by the investor, but you have to know how to work this into your Estimated Closing Statement (HUD1).

Short sales and foreclosures are TOUGH to navigate. Please reach out to us if you need help. Angie keeps everything confidential and will always help you with creative thinking so you have the most options with your home. Contact her at 949-338-7408!

Furthermore, Angie would love to connect with Asset managers, outsourcers, distressed property managers, and others in the banking industry who are looking for a quality agent who effectively works bank systems to get REO properties sold.

Did you know 1 in 10 US residents are considering owning international real estate? But how can you protect yourself from making a lemon investment? Thanks to OCR’s Global committee, we have some pointers for you!

Did you know 1 in 10 US residents are considering owning international real estate? But how can you protect yourself from making a lemon investment? Thanks to OCR’s Global committee, we have some pointers for you!  Nicaragua has been a growing spot to get deep discounts in real estate, and Michael personally lived there for 14 years, while raising 2 young daughters. It usually takes about 6-9 months after you visit Nicaragua and sign documents to receive your title, and buying is friendly to foreigners. The country has beautiful scenery, and also offers the following benefits:

Nicaragua has been a growing spot to get deep discounts in real estate, and Michael personally lived there for 14 years, while raising 2 young daughters. It usually takes about 6-9 months after you visit Nicaragua and sign documents to receive your title, and buying is friendly to foreigners. The country has beautiful scenery, and also offers the following benefits: Belize is a tiny country that wasn’t on the radar at all until recently, and now it’s exploding. The title process is 3-6 months, but you can complete a property transaction in just an hour if you’re there in person. English is the official language, so it’s easy to read contracts. Prices are reasonable right now, and the hotspot to check out is Ambergris Caye. Belize was also voted the “most wished for place to visit” on AirBnB, so an excellent consideration for your vacation rental. If you’re thinking of AirBnB, you will have to pay hotel tax, so be sure to factor that in. Speaking of air…air travel has doubled over the last 3 years to Belize, and there is still plenty of room for growth.

Belize is a tiny country that wasn’t on the radar at all until recently, and now it’s exploding. The title process is 3-6 months, but you can complete a property transaction in just an hour if you’re there in person. English is the official language, so it’s easy to read contracts. Prices are reasonable right now, and the hotspot to check out is Ambergris Caye. Belize was also voted the “most wished for place to visit” on AirBnB, so an excellent consideration for your vacation rental. If you’re thinking of AirBnB, you will have to pay hotel tax, so be sure to factor that in. Speaking of air…air travel has doubled over the last 3 years to Belize, and there is still plenty of room for growth.

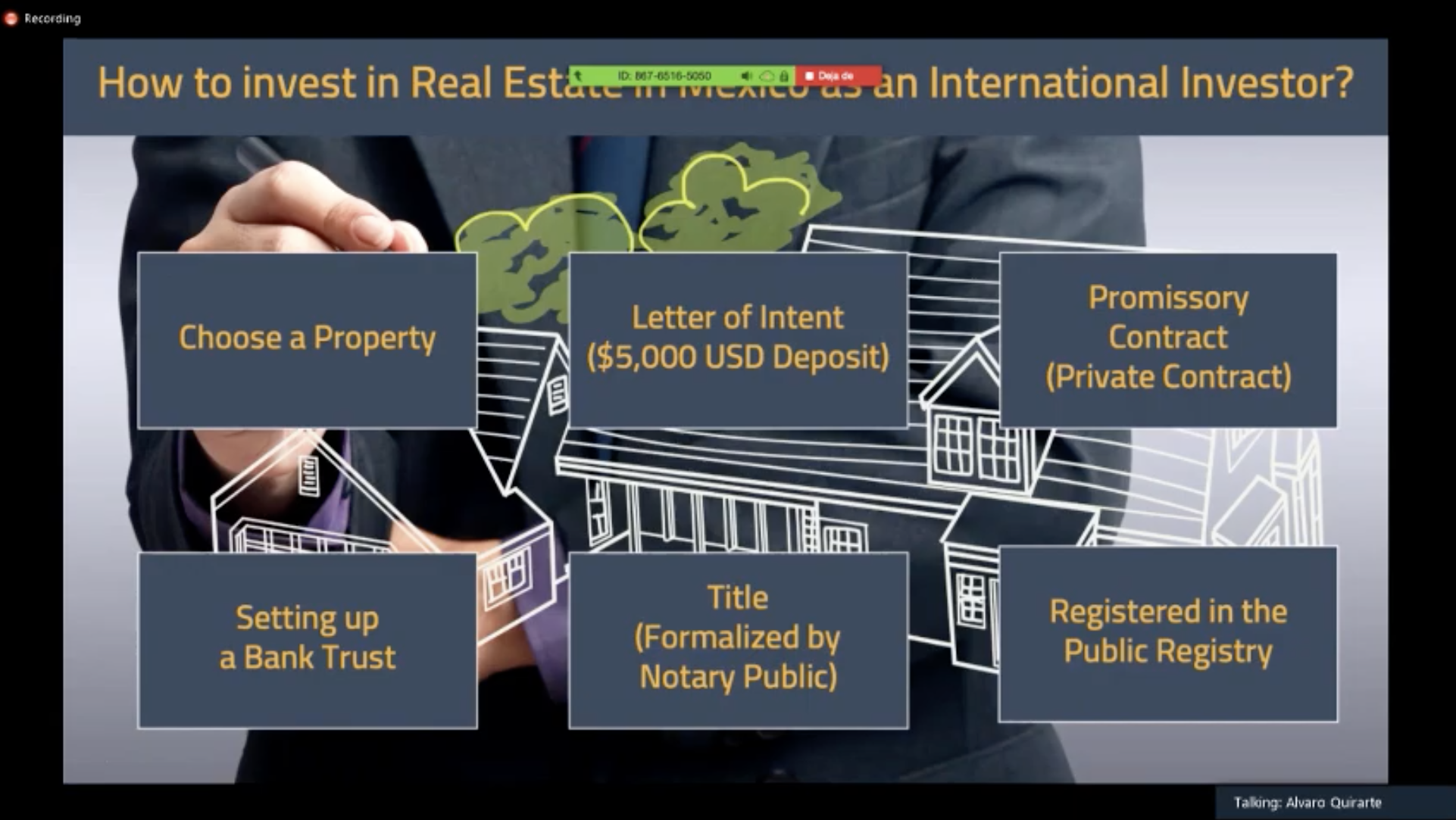

Real Estate expert Alvaro Quirante presented about Riviera Maya and the consistent growth of traffic into the Cancun airport, which creates opportunity. Travel is consistent all year long, so there is no on or off season. Currently they are creating a huge marina, and a theme park, which will create 5000 new jobs in the area. Tulum has been one of the cities that gets the best capital gains each year. A few reasons:

Real Estate expert Alvaro Quirante presented about Riviera Maya and the consistent growth of traffic into the Cancun airport, which creates opportunity. Travel is consistent all year long, so there is no on or off season. Currently they are creating a huge marina, and a theme park, which will create 5000 new jobs in the area. Tulum has been one of the cities that gets the best capital gains each year. A few reasons:

Today we’re spending a Saturday in Pomona at

Today we’re spending a Saturday in Pomona at  These purchase programs (and many others) have some caveats. The home must be your primary residence, and you must pass a homebuyer education class (approx 8 hours). Did you know taking homebuyer education classes before you buy make you 30% less likely to go into foreclosure? This is why many city, bank, and state programs will require you take one before receiving funds. Everyone wants you to succeed in your homeownership venture, so there are milestones like this in place to set you up to win.

These purchase programs (and many others) have some caveats. The home must be your primary residence, and you must pass a homebuyer education class (approx 8 hours). Did you know taking homebuyer education classes before you buy make you 30% less likely to go into foreclosure? This is why many city, bank, and state programs will require you take one before receiving funds. Everyone wants you to succeed in your homeownership venture, so there are milestones like this in place to set you up to win. Union Bank has a 3K down payment assistance grant for closing costs or down payment assistance, which can be layered with other programs. Sorry couldn’t find the link for this exact program, but here are the

Union Bank has a 3K down payment assistance grant for closing costs or down payment assistance, which can be layered with other programs. Sorry couldn’t find the link for this exact program, but here are the

NAWRB supports ALL women as they march to the beat of their own drum. Photo below:

NAWRB supports ALL women as they march to the beat of their own drum. Photo below:

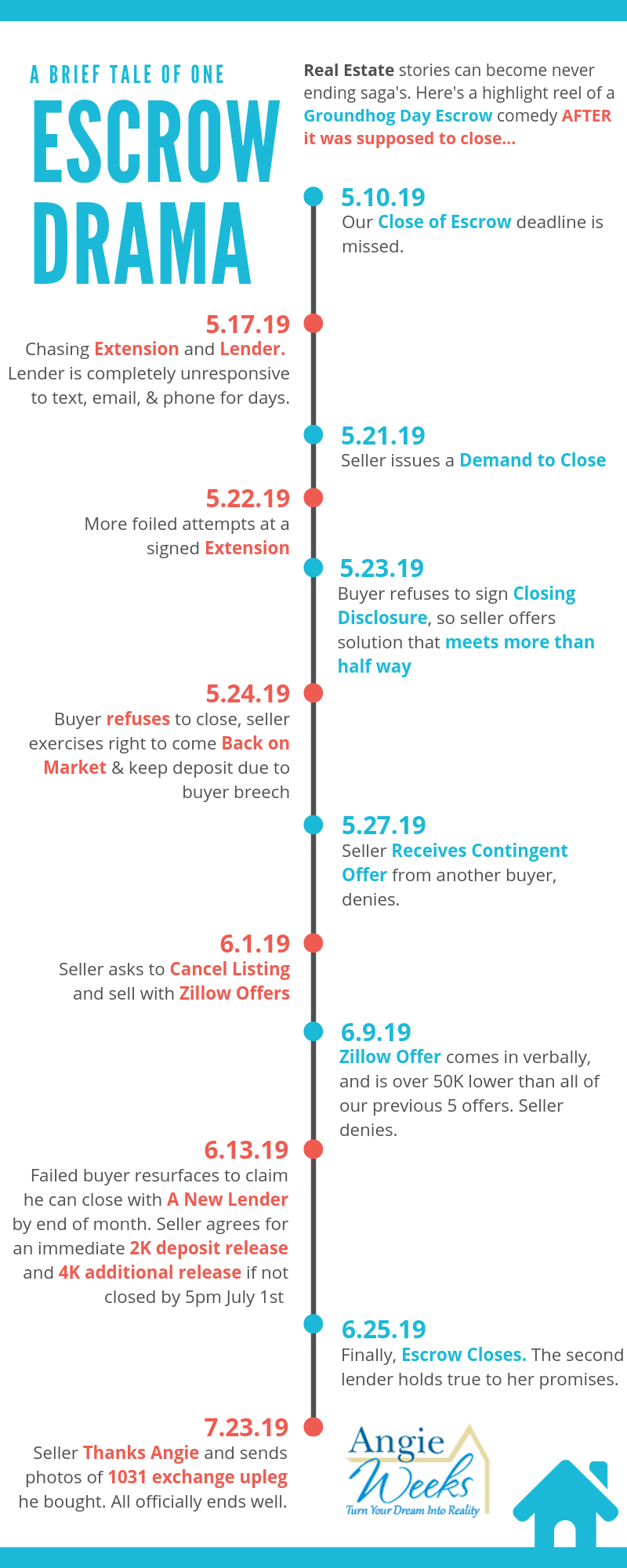

Do you love a good nail biting, back and forth drama flick? Or a hilarious Groundhog Day story that just couldn’t get any wackier? Since sometimes I feel like I’m in the middle of both of these flicks without a camera…I thought I would share with you. Getting this out there should feed your appetite for a good story, while I practice some humility and potentially lessen the PTSD. And **action**

Do you love a good nail biting, back and forth drama flick? Or a hilarious Groundhog Day story that just couldn’t get any wackier? Since sometimes I feel like I’m in the middle of both of these flicks without a camera…I thought I would share with you. Getting this out there should feed your appetite for a good story, while I practice some humility and potentially lessen the PTSD. And **action**