Archive for January, 2018

2018 Tax Reform & Housing Market Update with YPN

Hey everyone!

Hey everyone!

Today I’m at the Orange County Young Professionals Network breakfast; and Tony Capitelli, Government Affairs director at OCR, gave us the update on taxes and our housing market. If you’d like in on the scoop….read on 🙂

Not Fake News – Orange County Needs Housing Inventory

As previously stated in our post with Steven Thomas, we don’t have enough people selling their home in Orange County right now. Our current estimated time on the market is just 24 days – it’s a strong seller’s market. Furthermore, the ‘affordability’ factor in OC is around 20%, and prices continue to rise with the lack of inventory. Student loan debt keeps renters longer and longer.

Tony doesn’t believe we’re in another bubble, so this is our new normal in Orange County. The median sales price is now $800K. The prices continue to creep so high because of inventory, inventory, inventory. People are staying in their homes longer and longer. It also costs more to build here in OC, so that pushes up new home prices.

Tony doesn’t believe we’re in another bubble, so this is our new normal in Orange County. The median sales price is now $800K. The prices continue to creep so high because of inventory, inventory, inventory. People are staying in their homes longer and longer. It also costs more to build here in OC, so that pushes up new home prices.

Consequences of our inventory drought are less housing, longer commutes, more traffic…people are having to move outside of the city or county.

Even though all these updates aren’t great (especially to renters), please keep perspective. Homeownership is the still the best way to generate wealth for ‘the average Joe’.

What’s Up With 2018 Tax Reform

DISCLAIMER: This is information on what is in the new tax bill. This is not tax or legal advice…contact your CPA for that or ask us for a referral!!

Harmful tax provisions

- Raising the standard deduction

- Single filers – 12K / Joint filers 24K

- eliminates homeownership incentives for most

- Lowering the mortgage interest deduction

- Cap lowered from 1M to 750K

- Can only deduct HELOC remodeling

- Limit on State and local tax deduction

- Eliminates entertainment deduction

- Businesses can no longer deduct expenses for entertainment purposes. Sorry…less spoiling my clients and more giving it to Uncle Sam.

- Historic tax credit

- repeals moving expense deduction

- Except for military

Helpful tax provisions

- 20% passthrough for a business entity under 157K (single)

- Exclusion of gain on sale of principal residence

- We kept the 2 out of 5 year qualification 🙂

- Like kind exchanges

- 1031 exchange is still available

- Low income housing credit

- Child tax credit increased

- Medical expenses deduction remains

- Student loan interest deduction remains

- Keeps deduction for casualty losses

We’ve basically de-incentified homeownership and charity, which IMO sucks. The good news is that millennials still see the value in Homeownership and they are pretty darn charitable anyway 🙂 45% want to buy homes in the next 5 years. It’d be cool if we could vote for more benefits to support homeownership incentives in the future you guys! Follow NAR’s #HomeownershipMatters tag if you’d like to stay in the know there.

We’ve basically de-incentified homeownership and charity, which IMO sucks. The good news is that millennials still see the value in Homeownership and they are pretty darn charitable anyway 🙂 45% want to buy homes in the next 5 years. It’d be cool if we could vote for more benefits to support homeownership incentives in the future you guys! Follow NAR’s #HomeownershipMatters tag if you’d like to stay in the know there.

If you’d like to download Tony’s full presentation, just LIKE Orange County Young Professionals Network on Facebook – we’ll be posting it soon – or email Angie@AskAngie.com.

Read Full Post | Make a Comment ( None so far )2018 Housing Market Forecast by Steven Thomas

Always love to hear Steven Thomas’ yearly real estate forecast – he’s locally famous here in Orange County for his great quantitative economic forecasts. Today he spoke at Orange County Association of Realtors and gave us the scoop….here goes!

It’s a HOT Seller’s Market in OC. Already.

The average OC resident moves every 21 years. This is creating a seller draught for all homes on the market under 1.5M. On the other hand, if you’re lucky enough to own a property over 1.5M, that’s a buyer’s market right now. Typically the Orange County market is slow from Nov – Jan, heats up after Super Bowl, and stays hot well through May. Last year, our market was hotttttt the.whole.year. And it’s continuing into 2018 here.

I’m Going to Wait to Buy….Famous Last Words.

Buyers….please don’t wait for more inventory or prices to go down. Neither is projected to transpire anytime soon. The next trend that comes will be higher interest rates, and that will only compound your issues. Yes, it’s rough to find a home right now. You’ll have to compete with multiple offers, but the good news is that you’re buying a solid long term investment at historically low interest rates, so keep on it! With the right agent you will secure your dream home.

Good News Graph: Interest Rates Over the Last 50 Years

These interest rates are an absolute GIFT. Steven’s words: “Don’t look a gift horse in the mouth”. It’s ridiculous not to consider buying while you’re trashing at least 25K/year in rent. That’s like….a significant portion of your down payment. Because you can get in with just 3.5% down now 😉

Buyers, it’s time to suit up in your battle gear and plan to write at least 4-5 offers. It’s not you. It’s not your agent. It’s INVENTORY. We had 6% fewer homes come on the market in 2017 than the year before. We’re below 4,000 homes on the market, and our long term average is 8,000. We’re starting out this year similar to 2013, which was the lowest inventory in 5 years. There are only 91 condos active right now below 250K, so the low end is literally disappearing. And you can’t blame it on the foreigners, either. International buying is an insignificant 3%. Get in while you still can, PLEASE!

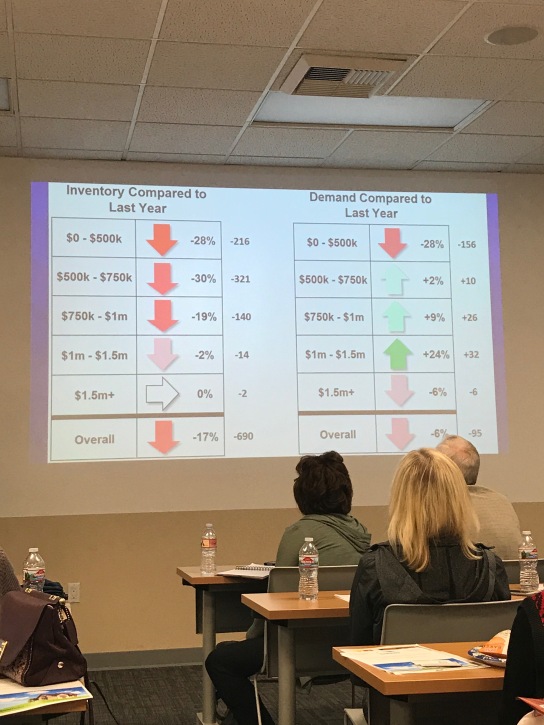

Homeowners, you’ve got the upper hand because you’re just not selling. Below is a comparison of 2016 inventory vs 2017 inventory. Almost everything is down. Yet the population and OC relocations continue to grow. Which are causing prices of our skimpy inventory to grow.

Where Are All of Our Property Sellers?

Why isn’t everyone selling right now? We’re in an up market…right? Well, there’s a slew of reasons, and here are some of them:

- refinanced into a 3% loan they just don’t want to lose

- it’s ‘cool’ to stay put right now

- not enough building to entice the move

- property taxes are grandfathered in low

- watching HGTV all day & remodeling instead

- nothing to buy (such a VICIOUS cycle)

Some people are literally becoming prisoners in their own homes, especially with the new tax laws. 64% of baby boomers literally plan to die in their home, following the hugely popular ‘aging in place’ trend. Until some of these boomers start to sell…or croak.. our market will be stalled.

If you’re considering selling… please do your fellow OC residents a favor & just do it! You’ve literally got buyers in line waiting to see your home. Here’s an inventory & demand year to year comparison:

Scared to sell? What about Taxes & Tax Reform?

Now that the max deduction is $12,000 for singles, and the max property tax deduction is $10,000, will that affect our market? It will absolutely affect many, because the median home price in Orange County is now over $700,000. Some buyers will not be able to write off everything they used to. Steven admits, It may NOT be a tax benefit to own a home in some in the upper ranges. But…It’s still way better than trashing 3-5K/mo on renting, though. And luxury rent is even higher than that. Steven doesn’t think the tax laws will have an adverse affect on our pricing at all this year; we are still projecting appreciation.

Steven Thomas’ 2018 Housing Market Forecast:

- Low distressed inventory

- return of the unrealistic overpriced seller

- normal housing cycle

- anemic inventory to start the year

- increase in number of move up sellers

- mild appreciation 4-5% (perspective. the ‘average’ home is due to increase 30K or more in value)

- interest rates to land at 4.25%

Only time will tell if these projections are right – but Steven’s usually on point. Feel free to comment your opinions and we’ll revisit this post in about a year 🙂 If you’d like more updates like this throughout the year, just fill out the form below or text ‘subscribe’ to Angie at 949-338-7408.